Jarrett Parr is a Financial Systems Implementer for SuiteDynamics, a NetSuite solutions provider. He enjoys analyzing and improving processes for both our company and clients. He also loves solving accounting and financial problems for growing businesses. Jarrett lives in Madison, WI, with his wife, Abbie, and their golden retriever, Clark.

The NetSuite Multi-Currency Feature: What You Need to Know About Exchange Rates and ERPs

Every international business must handle multi-currency transactions. Here's how to do it with minimum fuss.

If your company is large enough to need a NetSuite Cloud ERP, you might be large enough to operate in international markets—and multi-currency transactions complicate business operations to no end.

For example, you might have to maintain financial records in one currency while accepting invoices and purchase orders in another. You might also manage international subsidiaries that use various types of legal tender. Fortunately, you can simplify financial operations using the NetSuite multi-currency feature.

Key Takeaways

- Global Business Management - NetSuite's multi-currency feature, part of the OneWorld solution, supports over 190 currencies and exchange rates. Businesses can easily transact with international vendors and customers while managing various tax structures.

- Automated Currency Exchange - The system automatically converts transactions between currencies at current exchange rates without manual intervention. It also offers the option to set fixed rates during monthly close periods.

- Flexible Currency Assignment - Businesses can assign multiple currencies to the same customer or vendor, accepting any legal tender they use. However, payments must be applied in the transaction's specific currency.

- Multi-Book Accounting Capabilities - NetSuite allows users to maintain parallel financial records in different currencies. It keeps primary books in the base currency and secondary books in other currencies to meet varying regulatory standards, automatically updating all books from a single transaction entry.

- Comprehensive Revaluation System - The platform handles currency fluctuations through various revaluation transaction types, including Unrealized Gain/Loss (month-end revaluations), Realized Gain/Loss (upon payment/closure), and Base Currency Adjustments, to ensure accurate financial reporting.

Why is the NetSuite multi-currency feature important?

The NetSuite multi-currency feature is a part of the OneWorld global business management solution. It supports more than 190 currencies and exchange rates and a range of payment options.

This functionality allows your business to easily transact with vendors and customers worldwide. It also helps manage a variety of international tax structures.

What can the NetSuite currency exchange rate tool do?

Automate currency exchange rate updates - Perhaps, the best part of NetSuite’s currency exchange rate integration is its automation. For instance, you can maintain your financials in USD but enter invoices that use euros. The system automatically converts the expenses into USD at the day’s exchange rate. You don’t even have to click a button.

You also have the option to set the exchange rate, so conversions won’t adjust to rate fluctuations. This feature comes in handy during the monthly close.

Work with customers and vendors using more than one currency - Or you may work with customers or vendors using multiple currencies. That’s not a problem with NetSuite multi-currency capabilities. You can assign various currencies to a customer or vendor and accept any legal tender they use. Note, however, that you must apply payment in the transaction’s specific currency.

Generate and update consolidated exchange rates - Your business may have an international network of parent and child subsidiaries. If so, NetSuite can generate consolidated exchange rates each accounting period so currencies translate correctly from one subsidiary to another. It also regularly updates these exchange rates to keep your financial reports accurate.

Allow for multi-book accounting with various currencies – NetSuite OneWorld allows users to keep multiple sets of parallel financial records, each in a different currency. So, you can keep primary book in your base currency and secondary books in other legal tenders to fulfill varying regulatory standards by country or industry. You can also include Fixed Assets in multiple books with separate currencies and varying depreciation methods. And best of all, the system automatically updates all books from one source of transaction entry. No duplicate data entry or adjustments required.

And, of course, NetSuite multi-currency tools are user-friendly, so your accountants don’t need IT specialists to set exchange rates or automate conversions. Instead, they can program the automation within minutes, saving your business time, money, and headaches.

How to set up a NetSuite currency exchange rate

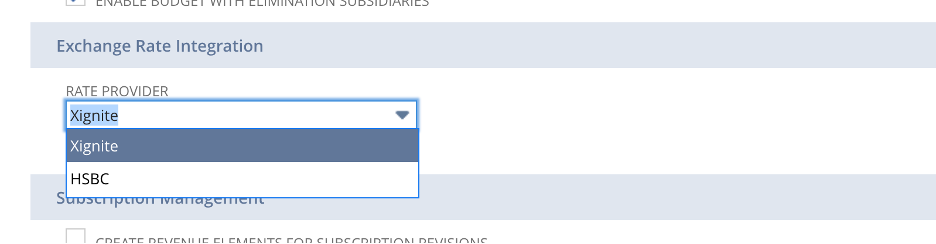

NetSuite calculates currency conversions using two currency exchange rate API providers, Xignite and HSBC.

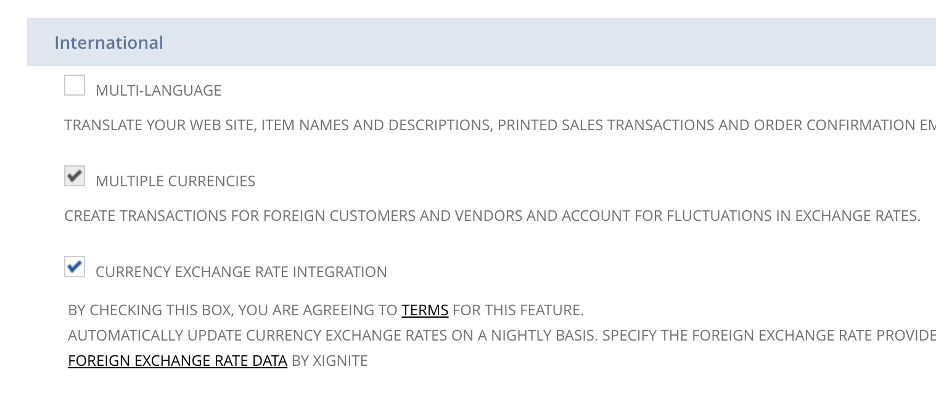

To enable NetSuite currency conversion, click the Currency Exchange Rate Integration checkbox. Find it by navigating to Setup > Company > Enable Features under the company subtab. (Note: Multiple currencies must be selected first.)

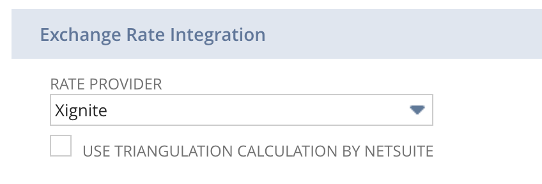

Then, you can select the rate provider. Find it by navigating to Setup > Accounting > Accounting Preferences.

How to select an API provider in NetSuite

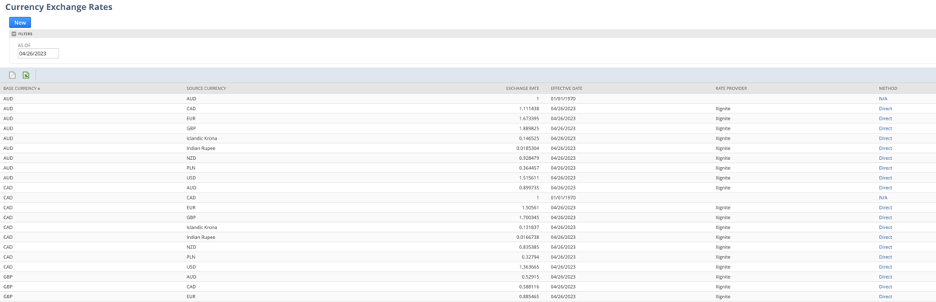

Xignite and HSBC support different currency pairs. You can see which pairs your system supports by navigating to Lists > Accounting > Currency Exchange Rates.

You have two options if your current provider doesn’t support a needed pairing. First, select the other currency provider to see if they have the pairing or enable the NetSuite multi-currency feature’s triangulation calculation.

Triangulation calculation uses a third “matchmaker” currency to convert the pair. For example, suppose you need to convert the United States Dollar to the Icelandic Krona, but the pair is unavailable. Instead, you can use triangulation, which would use a dollar-to-euro pair and a euro-to-krona pair to perform the task.

You can enable triangulation underneath the Rate Provider dropdown.

How the NetSuite multi-currency feature handles revaluation transactions

Exchange rates fluctuate constantly, impacting the values of all financial transactions in a NetSuite multi-currency environment. Currency revaluation accounts for those fluctuations by measuring the change in valuation and posting it as a loss or gain. NetSuite features a variety of currency revaluation transactions based on the process type.

Unrealized Gain/Loss – The month-end currency revaluation process produces this revaluation transaction. Open balance sheet accounts are revalued based on current exchange rates if the account uses a foreign currency. This requires you to enable the Currency Revaluation permission in NetSuite.

The system doesn’t delete these transactions if you rerun the revaluation in the same period. Instead, it creates additional currency revaluation transactions to reflect any changes.

Reversal of Unrealized Gain/Loss – As the name suggests, this type of transaction reverses the Unrealized Gain/Loss from the previous month-end close. The system will post the reversal on the first day in the period following the Unrealized Gain/Loss transaction.

You can’t edit or delete this transaction type. But if you edit or delete an associated month-end revaluation, the system automatically updates or deletes the reversal.

Realized Gain/Loss – This transaction records exchange rate variances between currencies upon closure or payment. As the name suggests, it records differences that have occurred or are “realized” because payment in a foreign currency is being transacted. Conversely, think of an “unrealized” gain/loss as a value difference that would occur if a transaction took place.

Like “reversal of Unrealized Gain/Loss,” you can’t delete these transactions. However, a source transaction adjustment may change a previously posted gain or loss. In that case, NetSuite automatically deletes the associated currency revaluation transaction.

Rounding Gain/Loss – This transaction occurs when a realized gain/loss is recorded but it doesn’t balance due to using two decimal places in accounting. These transactions typically display +/- $.01 values because that’s all the system should need to balance the account.

These transactions can’t be deleted. Still, NetSuite will eliminate previous currency revaluations if source transaction alterations change previously posted gain or loss.

Base Currency Adjustment – The month-end currency revaluation process creates this type of revaluation. This transaction zeros out accounts that may otherwise have residual balances caused by fluctuations in exchange rates. This is done by posting an adjustment to a currency gain/loss account and the account with the residual balance.

The transaction also gets rid of amount reversals and continuous revaluation for that account. Additionally, the system will automatically delete and recreate the transactions if you perform the revaluation again in the same period.

If you’re interested in the NetSuite OneWorld global business management system, you’ll need a competent consulting firm to set it up. SuiteDynamics employs several experts who understand NetSuite multi-currency features and the complex accounting they use. As a result, we can evaluate your company, identify your pain points, and guide you through a smooth OneWorld implementation. Call today to learn more.

Disclosure: This article was developed with the assistance of Claude, an AI created by Anthropic. Our editorial team used Claude as a collaborative writing tool, carefully reviewing, editing, and fact-checking all AI-generated content. The final text has been thoroughly vetted to ensure accuracy, clarity, and alignment with SuiteDynamics' editorial standards. We take full responsibility for the content presented in this article, maintaining our commitment to providing reliable and informative insights to our readers.