Grace Martin is the Principal Finance Consultant at SuiteDynamics and possesses a unique dual expertise in both technology and finance. Her extensive experience spans virtually every financial position from auditor to CFO, complemented by her management of IT departments and leadership of multiple system implementations. She also spent nine years as a contract accountant and systems analyst for major manufacturing plants and ten years as Director of Finance and Management Information Systems at Dippin Dots, with roles as Controller and Global Cost and Pricing Analyst at Siemens Rail. At SuiteDynamics, Grace specializes in developing custom financial solutions that enhance native NetSuite functionality, with a personal focus on understanding client financial needs and ensuring correct GL impact for reporting.

How to Use NetSuite Bank Reconciliation to Streamline Bookkeeping

NetSuite won't work if you don't know how to use it. Get step-by-step instructions for accepting customer payments, making deposits, matching bank data, and completing bank reconciliations.

Underutilized NetSuite Enterprise Resource Planning (ERP) software is a tragedy—particularly for a company’s financial department. The system has many automated features, like NetSuite Bank Reconciliation and Bank Data Matching, that lighten accounting workloads and free employees up for more strategic tasks. They also increase data accuracy so your financial records can create a reliable foundation for your company’s success.

You're wasting time and money if you’re not fully utilizing NetSuite’s automated financial features.

We want you to experience NetSuite’s full power so your business can push ahead of the competition. SuiteDynamics experts offer thorough instruction highlighting NetSuite’s most helpful tools and teaching you how to maximize them.

Our quick guide below explains NetSuite Bank Reconciliation and Bank Data Matching features. It also includes step-by-step instructions for receiving customer payments, making bank deposits, matching bank data, and completing bank reconciliations. Read through the post, then schedule a free consultation with SuiteDynamics experts to start the training program that guides your NetSuite success.

What Is NetSuite Bank Reconciliation?

Bank reconciliation ensures the accuracy and integrity of your company's financial records. It compares and reconciles the transactions in NetSuite with those in your bank statements. This process is essential for several reasons, all of which contribute to better financial management and decision-making.

1. Detecting Errors and Discrepancies

NetSuite bank reconciliation helps uncover errors, omissions, and discrepancies in financial records. These can include mistakes in recording transactions, missing entries, or incorrect amounts. Detecting and rectifying these errors promptly is crucial for maintaining accurate financial statements.

2. Fraud Prevention

NetSuite bank reconciliation acts as a safeguard against financial fraud. By reconciling bank statements, you can identify unauthorized or fraudulent transactions, such as embezzlement, unauthorized withdrawals, or forged checks. Timely detection can help prevent further financial losses and hold those responsible accountable.

3. Cash Flow Management

Accurate bank reconciliation ensures the cash balances recorded in a company's books match those in the bank account. This consistency is vital for effective cash flow management because it provides an accurate picture of the company's available cash resources. Timely and accurate reconciliations help plan for short-term and long-term financial needs.

4. Financial Statement Accuracy

NetSuite bank reconciliation plays a crucial role in maintaining the accuracy of financial statements, such as the balance sheet and income statement. These statements are vital for assessing a company's financial health and making informed decisions. Inaccurate financial statements can mislead stakeholders and investors, leading to poor financial decisions.

5. Compliance and Auditing

Many regulatory bodies and financial standards, such as Generally Accepted Accounting Principles (GAAP), require accurate and consistent financial reporting. NetSuite bank reconciliation is a fundamental part of ensuring compliance. It also facilitates the auditing process, as auditors rely on reconciled bank statements to verify the accuracy of financial records.

6. Budgeting and Planning

Effective bank reconciliation enables better budgeting and financial planning. With accurate data on cash balances and transactions, organizations can make informed decisions about spending, investments, and revenue projections. Excellent reporting is crucial for the sustainable growth and success of a business.

7. Credibility and Trust

Accurate bank reconciliations enhance a company's credibility and build trust with stakeholders, including investors, creditors, and customers. Reliable financial records demonstrate the company's commitment to transparency and accountability.

8. Resolution of Outstanding Items

NetSuite bank reconciliation helps identify outstanding items such as uncleared checks, deposits in transit, or bank fees. Resolving these items ensures that the cash account is up-to-date and all outstanding items are either cleared or accounted for.

9. Preventing Overdrafts and Insufficient Funds

Regular reconciliation helps prevent overdrafts and the potential financial penalties associated with insufficient funds in a bank account. By monitoring the balance and transaction activity, a company can proactively maintain sufficient funds and avoid costly bank charges.

Discover how your team can best use NetSuite bank reconciliation tools to maintain accurate books and keep your company operating at 100%. Schedule your free consultation with SuiteDynamics.

Understanding NetSuite's Bank Data Matching and Reconciliation

We’ll dig into NetSuite bank reconciliation instructions in a moment, but first, let's discuss the Bank Data Matching and Reconciliation feature. It’s one of NetSuite’s stand-out tools and streamlines the matching and reconciling of bank transactions with your financial records. It automates this process, significantly reducing manual effort and human errors. Here's how the tool works.

1. Bank Statement Import

NetSuite allows users to import bank statements directly into the system. This feature supports various file formats, making it adaptable to your bank's requirements.

2. Transaction Matching

The system intelligently matches imported bank transactions with existing financial data within NetSuite. This includes payments, invoices, sales orders, and more.

3. Rule-Based Matching

NetSuite allows you to set up rules and preferences for matching transactions. For instance, you can define rules for specific bank accounts or transaction types.

4. Auto-Matching

With the predefined rules, the system can automatically match transactions, saving time and reducing the need for manual intervention.

5. Manual Reconciliation

In cases where automatic matching is not possible, the system provides an intuitive interface for manual NetSuite bank reconciliation, with real-time visibility into unmatched transactions.

SuiteDynamics can help your team incorporate the Bank Data Matching and Reconciliation feature into daily operations. We’ll also train your staff to fully utilize NetSuite’s accounting tools to hone your financial processes and help your company rise.

How to Reconcile Bank Statements in NetSuite

Receiving Customer Payments

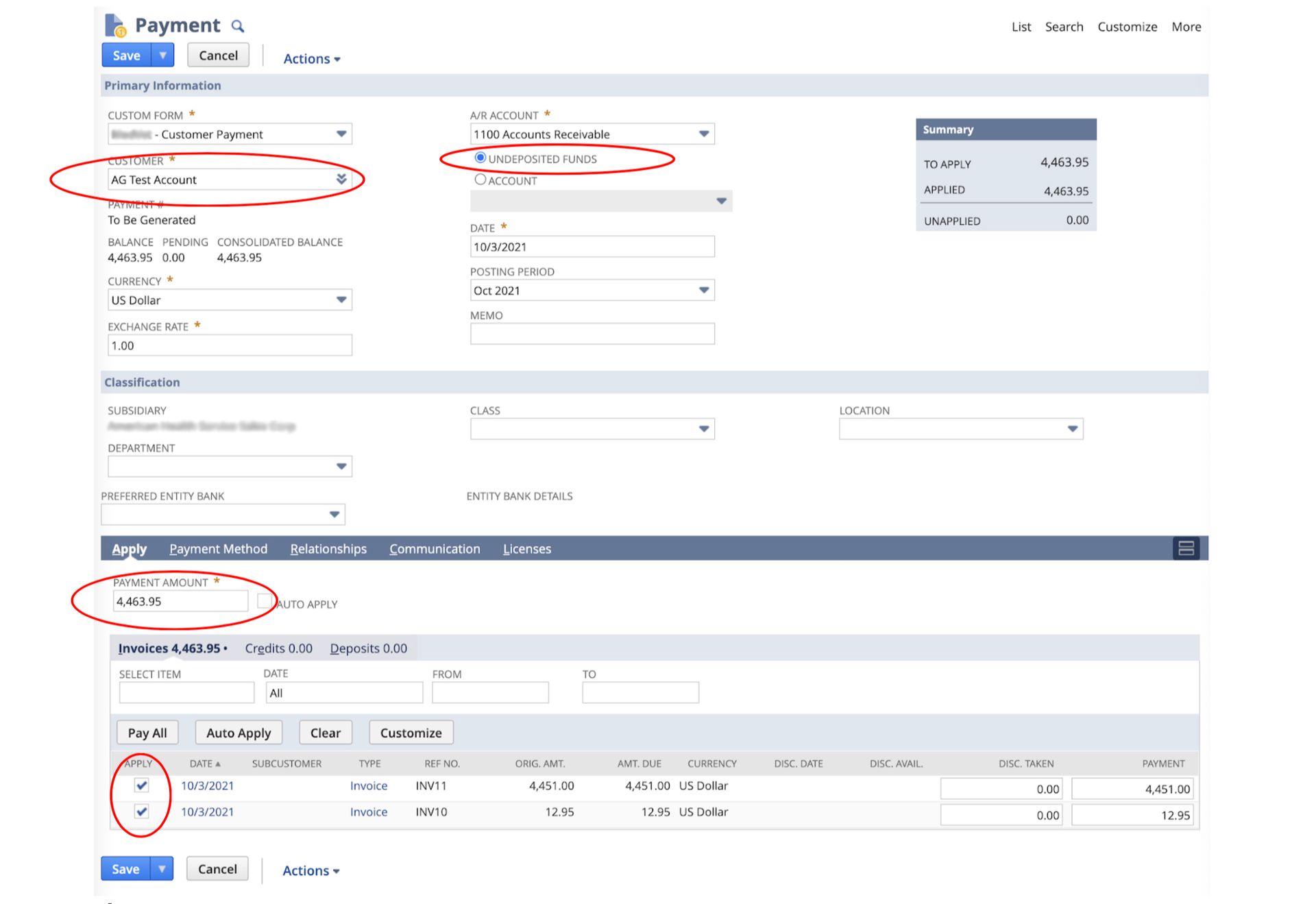

- Navigate to Transactions>Customers>Accept Customer Payments.

- Enter Customer. The tab and other required fields will populate, including any open invoices.

- Check all that have been paid with this cash receipt.

- Compare the payment amount to the total from the check or credit card.

Note: The funds hit the general ledger “undeposited funds” until the deposit clears, which is then reflected in the next transaction.

Often, credit card web deposits hit a bank account directly, and they are reflected in NetSuite as individual transactions.

5. Select

Payment Method.

a. If you’ve received a check, enter the check number.

b. If you’ve received a credit card payment, enter the card type. It’s important to note whether the “operation was successful” or the “card was rejected.”

6. Click Save.

Making Deposits

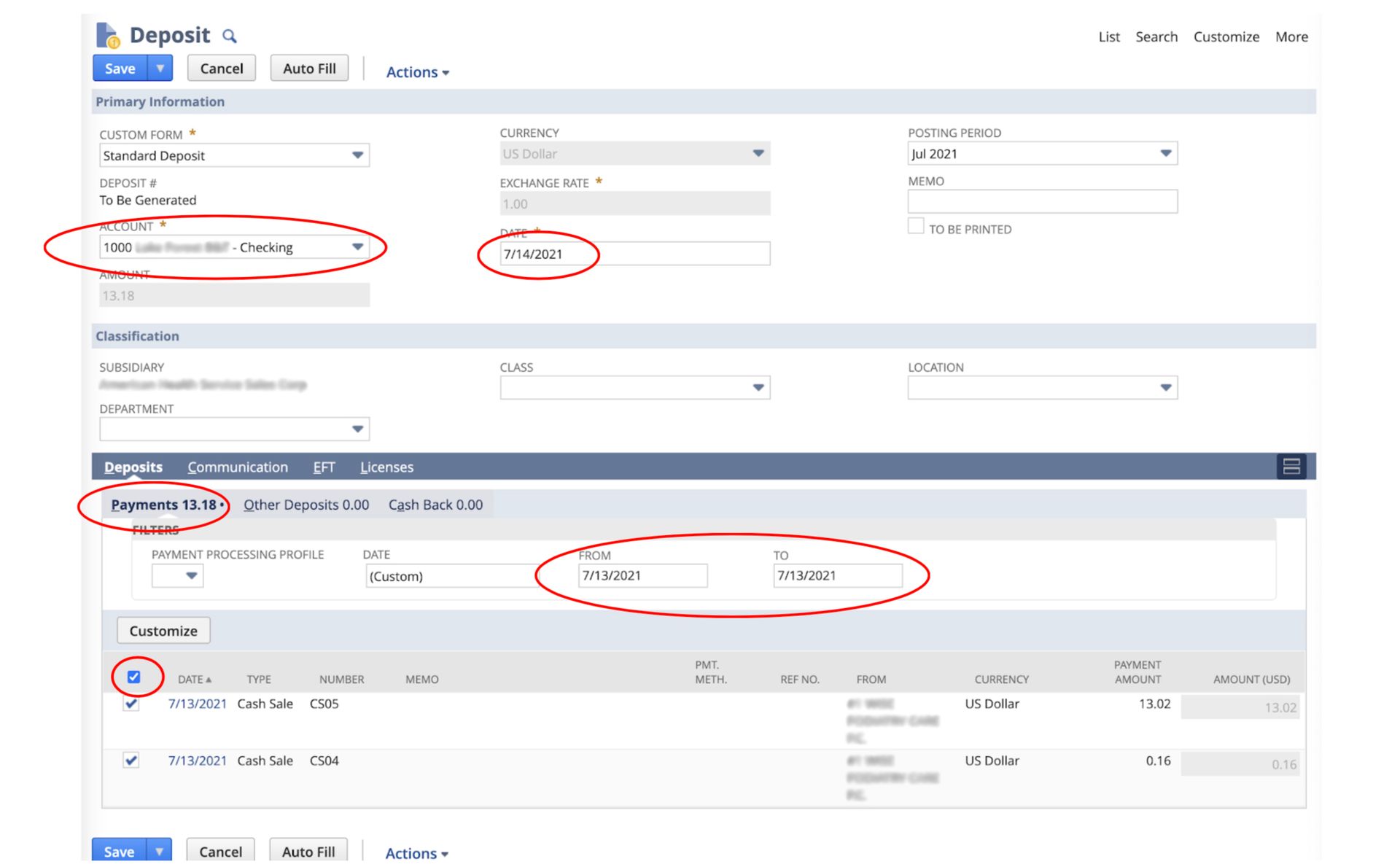

- Navigate to Transactions>Bank>Make Deposits.

- Ensure you are on the Payments tab.

- Select a bank account under Account.

- Enter the date that the deposit hit the bank.

- Enter From – To dates. (The From Date and the To Date are usually the same day, and the range begins one or two days preceding the deposit date.)

- Check all transactions in the deposit. Checking the box in the header automatically checks all boxes in the date range.

- Compare the Deposit total from the Bank to Payments total.

- Click Save.

Reconciling Bank to Book

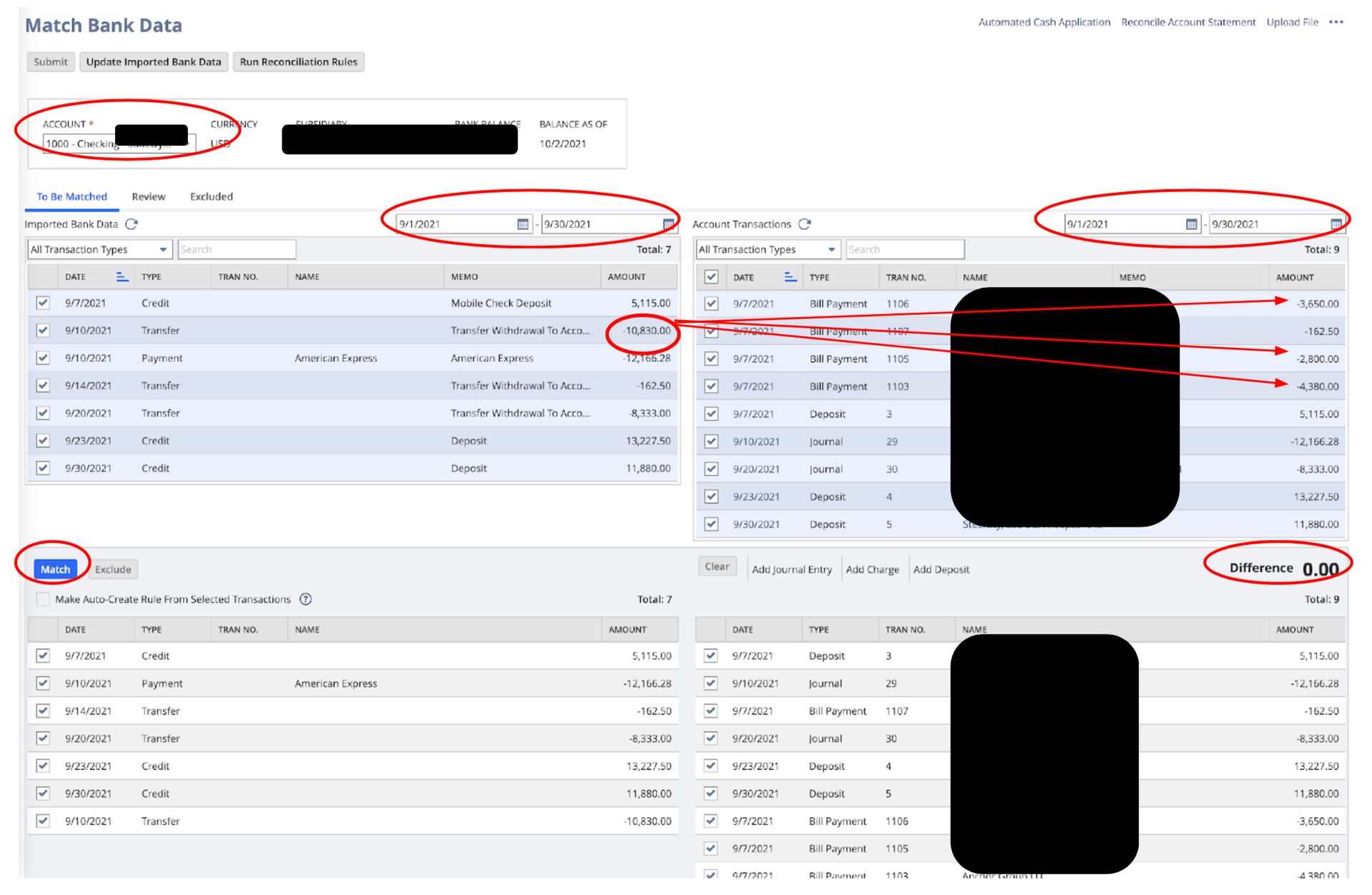

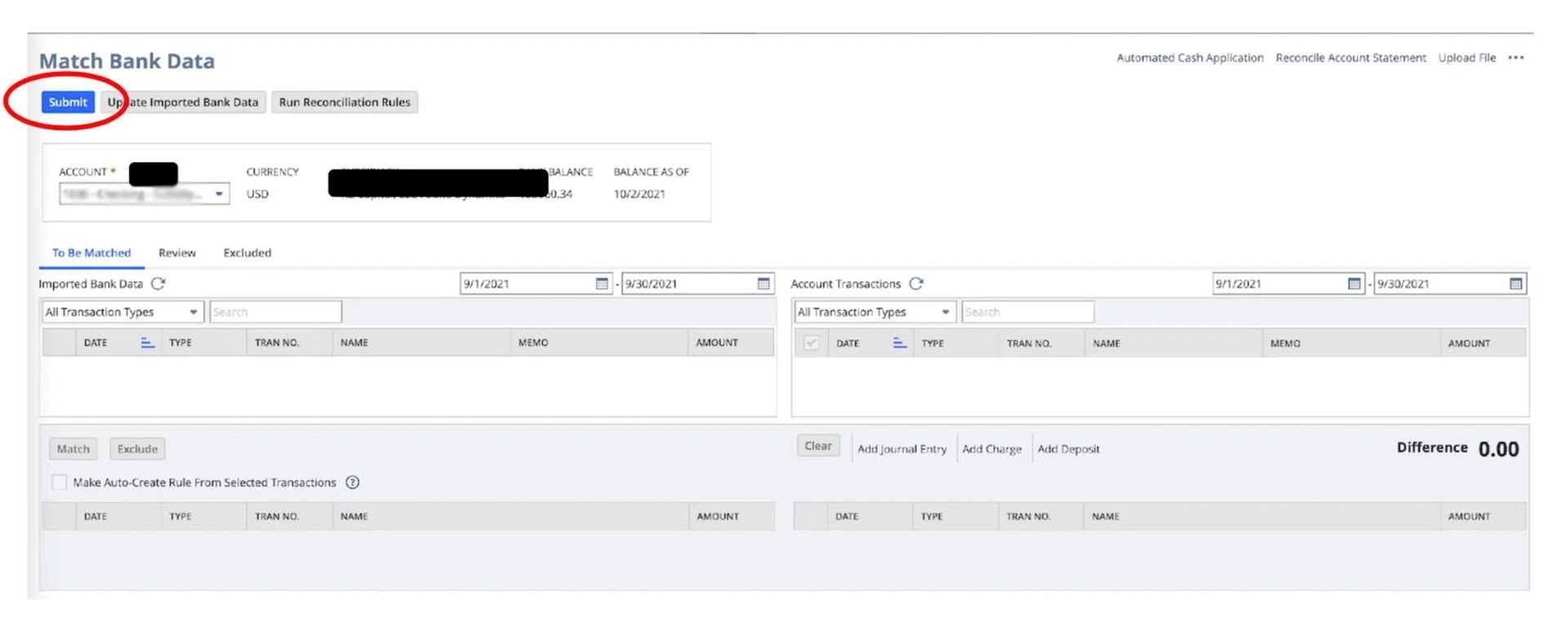

- Navigate to Transactions>Bank>Match Bank Data.

- Select your bank account. The imported transactions will appear on the left, and the NetSuite transactions will appear on the right.

- Set the date range on both sides.

- Most transactions will have a one-to-one correspondence between the sides. However, there can be a summary transaction on one side that relates to multiple transactions on the other.

- Select transactions on both sides, and they will appear on the bottom half of the screen. They will be located next to a running tally of the differences between them.

6. Click Match after selecting all transactions from the bank so the bank import and NetSuite have a $0 difference.

7. The transactions will disappear.

8. Click Submit.

Note: This can happen multiple times a month to track available cash.

Reconciling a Bank Statement

- Navigate to Transactions>Bank>Match Bank Data.

- Select the correct bank account under Account.

- Click Reconcile Account Statement.

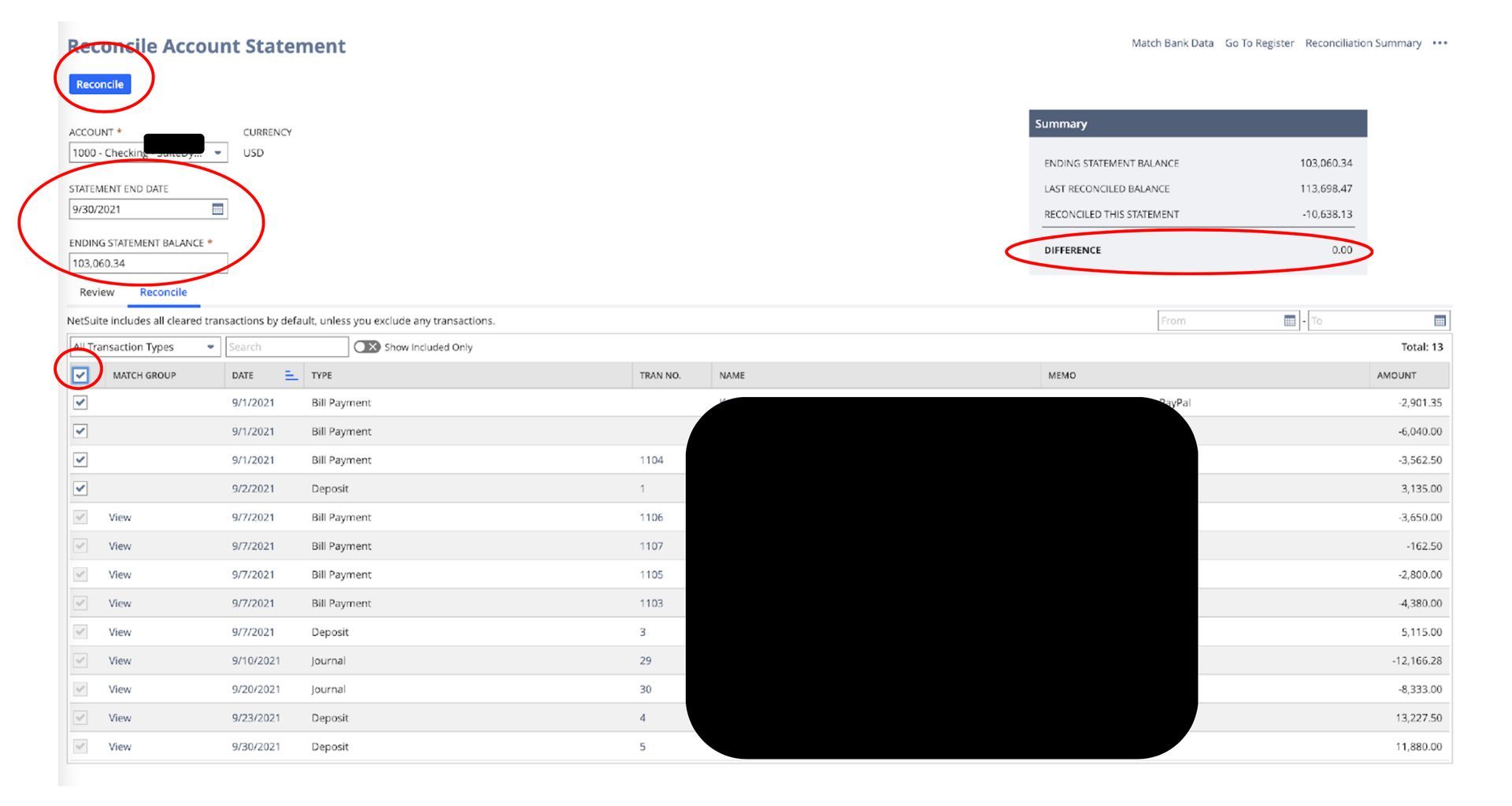

4. Enter the Statement End Date.

5. Enter the Ending Statement Balance.

6. Select transactions that cleared the bank statement. You may click the box in the header line, and all transactions will be selected.

7. If the Difference in the upper right corner is zero, click Reconcile.

SuiteDynamics experts can explain NetSuite bank reconciliation steps in further detail during NetSuite training. We can also highlight other features that can improve your accounting practices.

Give Your Company the Best Chance for Success

You know precise and efficient bookkeeping is crucial for your company’s productivity and growth.

NetSuite bank reconciliation features are some of the best tools on the market for streamlining and automating financial processes—if you know how to use them.

We don’t want your company to invest in a NetSuite system only to suffer from clumsy financial operations and questionable records. SuiteDynamics experts can train your staff to maximize the software for quicker, sharper bookkeeping.

Discuss your needs for NetSuite education during your free consultation with SuiteDynamics experts, and keep your business organized, accurate, and growing.

Frequently Asked Questions

1. Does NetSuite allow me to set up auto-matching rules?

Yes, NetSuite does allow you to set up auto-matching rules. These rules are part of NetSuite's bank reconciliation functionality and help automate the process of matching transactions.

With NetSuite's auto-matching capabilities, you can:

- Create custom rules that automatically match bank transactions with corresponding transactions in your NetSuite system.

- Set specific criteria for matching, such as amount, date range, and transaction type.

- Reduce manual reconciliation work by having the system identify probable matches.

- Streamline your month-end close process through automated matching.

To set up auto-matching rules in NetSuite, you would navigate to the reconciliation rules module and configure the matching preferences based on your organization's needs. These rules can be tailored to different bank accounts and transaction types.

The auto-matching functionality helps improve accuracy while significantly reducing the time your accounting team spends on reconciliation tasks. This allows your employees to focus on more strategic financial activities instead.

2. Will NetSuite automatically post customer deposits?

Yes, NetSuite can automatically post customer deposits through the proper configuration of its automatic cash application module. When set up correctly, the platform will create and post customer deposit transactions upon payment receipt and can automatically apply these deposits to invoices based on predefined rules.

This automation typically works through payment gateway integrations or bank feeds that import transaction data. NetSuite matches incoming payments against open transactions and posts them according to your configured settings.

For effective implementation, you must configure appropriate payment methods, set up necessary integrations with payment processors or bank feeds, and define deposit allocation rules. Organizations implementing these automated processes typically see reduced manual data entry, faster cash application, and improved financial reporting accuracy.

3. Does NetSuite have a limit on the number of bank accounts you can integrate?

Yes, NetSuite limits the number of bank accounts you can integrate to 20 per instance.

This means that while you can set up multiple bank accounts within your NetSuite environment, you can only establish direct bank feeds or automated connections with up to 20 different accounts. This limitation applies to the standard NetSuite banking integration capabilities.

4. Is there a workaround if you exceed that limit?

Yes, there are several workarounds if you exceed NetSuite's 20 bank account limit for integration:

- Use CSV imports: You can manually download transaction data from additional bank accounts and import it into NetSuite using CSV files. While this requires more manual effort, you can bring in data from unlimited accounts.

- Third-party integration solutions: Several NetSuite partners offer banking integration tools that can overcome the native limit. These specialized solutions can expand your connection capabilities beyond the standard 20 accounts.

- Rotate active connections: If you don't need real-time data from all accounts simultaneously, you can rotate which accounts are actively connected based on your reconciliation schedule.

- Custom integration: For organizations with significant requirements, a custom integration using NetSuite's API can be developed to handle additional bank connections beyond the standard limit.

- Bank account consolidation: In some cases, organizations might consider consolidating certain banking activities to reduce the number of accounts requiring direct integration.

The best approach depends on your needs, transaction volumes, and available resources. Many organizations with complex banking structures use a combination of these methods to manage their banking data effectively in NetSuite.

5. If my bank security won’t allow the native NetSuite bank integration, is there a way to get my bank data into NetSuite?

Yes, there are several ways to get your bank data into NetSuite if your bank's security won't allow the native integration:

- Manual CSV imports: You can download transaction data from your bank's online portal as CSV files and import them directly into NetSuite. While this requires manual steps, it works with virtually any bank.

- Third-party integration providers: Several specialized services can bridge the gap between high-security banks and NetSuite. These providers often have additional security protocols that may satisfy your bank's requirements.

- Bank statement uploads: NetSuite allows you to manually upload electronic bank statements (BAI, OFX, QBO formats) into the system for reconciliation purposes.

- Custom API integration: For organizations with technical resources, a custom integration using your bank's API (if available) and NetSuite's web services can be developed to create a secure connection that meets your bank's security standards.

Most organizations with strict bank security requirements find that combining CSV imports and scheduled reconciliation processes provides a practical solution until more automated options become available.

We pull information from NetSuite material, SuiteDynamics experts, and other reliable sources to compose our blog posts and educational pieces. We ensure they are as accurate as possible at the time of writing. However, software evolves quickly, and although we work to maintain these posts, some details may fall out of date. Contact SuiteDynamics experts for the latest information on NetSuite ERP systems.

Part of this text was generated using GPT-3, OpenAI’s large-scale language-generation model. After generating the draft language, our team edited, revised, and fact-checked it to ensure readability and accuracy. SuiteDynamics is ultimately responsible for the content of this blog post.