Grace Martin is the Principal Finance Consultant at SuiteDynamics and possesses a unique dual expertise in both technology and finance. Her extensive experience spans virtually every financial position from auditor to CFO, complemented by her management of IT departments and leadership of multiple system implementations. She also spent nine years as a contract accountant and systems analyst for major manufacturing plants and ten years as Director of Finance and Management Information Systems at Dippin Dots, with roles as Controller and Global Cost and Pricing Analyst at Siemens Rail. At SuiteDynamics, Grace specializes in developing custom financial solutions that enhance native NetSuite functionality, with a personal focus on understanding client financial needs and ensuring correct GL impact for reporting.

A Quick and Easy Guide to NetSuite Credit Card Processing

A NetSuite ERP can increase efficiency and accuracy in all your company's financial processes. You just need the right training to maximize it.

NetSuite’s financial tools can revolutionize your business. They can automate tedious tasks, improve data accuracy, and increase overall financial visibility—if you know how to use them.

We know how steep the learning curve for a NetSuite Enterprise Resource Planning (ERP) system can get. It’s complex software, and it takes time to figure out every feature—time you probably don’t have. SuiteDynamics can provide your company with various educational materials, like the NetSuite credit card processing tutorial below. We can even develop and conduct a custom training program for your team to address your system issues.

Read our tutorial and get vital information for operating your NetSuite ERP software. Then, schedule a free consultation with SuiteDynamics experts to discuss an in-depth training program that will answer all your system questions and guide your team toward NetSuite success.

What Is the Matching Principle and Why Does It Matter?

Before diving into the tutorial below, we must cover a basic accounting concept integral to NetSuite credit card processing: the Matching Principle.

Financial staff using the Matching Principle will record an expense in the period it occurs rather than the period it’s paid. For example, suppose your business sponsors a booth at an end-of-the-year trade show. You'll probably send representatives to the event, incurring related costs in the current year but paying them in the following year. Yet if you follow the Matching Principle, your accountants will record the total amount with your current year’s expenses.

Companies use the Matching Principle for various reasons, including:

- Improved Accuracy: This method ensures revenue and expenses possess the same value at the same time, making data more reliable.

- Better Understanding of Profits: The Matching Principle pairs expenses and revenue, ensuring financial statement consistency. It also streamlines financial data, allowing potential investors to assess your company’s risk better.

NetSuite credit card processing tools help businesses follow the Matching Principle and maintain accurate records. SuiteDynamics experts can help guide you through these features and others that expedite your financial processes. Schedule your free consultation and discover how efficient accounting can become.

How to Conduct NetSuite Credit Card Processing

The following instructions encompass the entire NetSuite credit card process. You’ll learn how to:

- Best assign vendors and general ledger codes to your credit card transactions.

- Load credit card transactions via CSV.

- Match the data load to the transactions you've imported into NetSuite directly from your credit card company.

- Pay a credit card bill.

- Reconcile a monthly credit card statement.

Let’s start with your vendors.

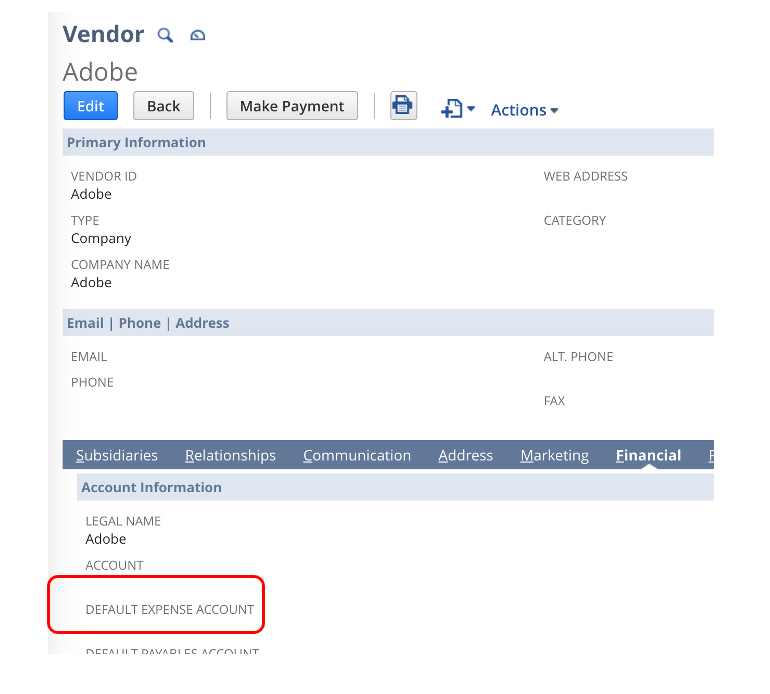

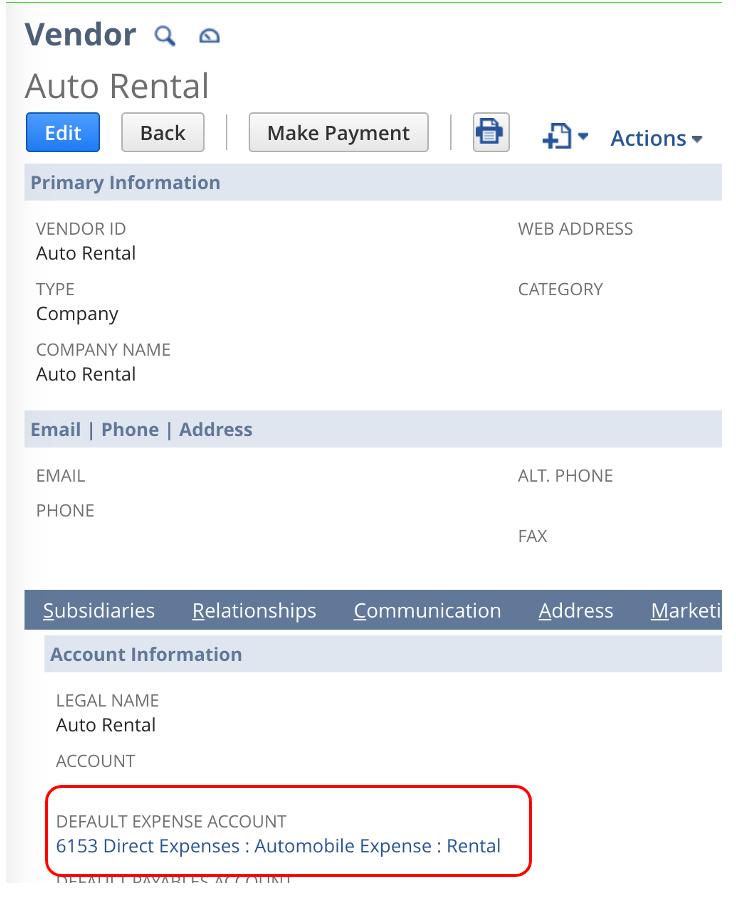

1. Assign Default Expense Accounts to all NetSuite Vendors.

2. Create NetSuite Vendors for the significant charges you wish to track.

3. Create “generic” NetSuite Vendors for charges that don’t need to list exact vendors (i.e., gas, food, hotel, etc.). Assign the appropriate default expense accounts.

4. Create a NetSuite vendor mapping document to reuse monthly during this process. It should include a list of all vendors with their internal IDs and default expense accounts.

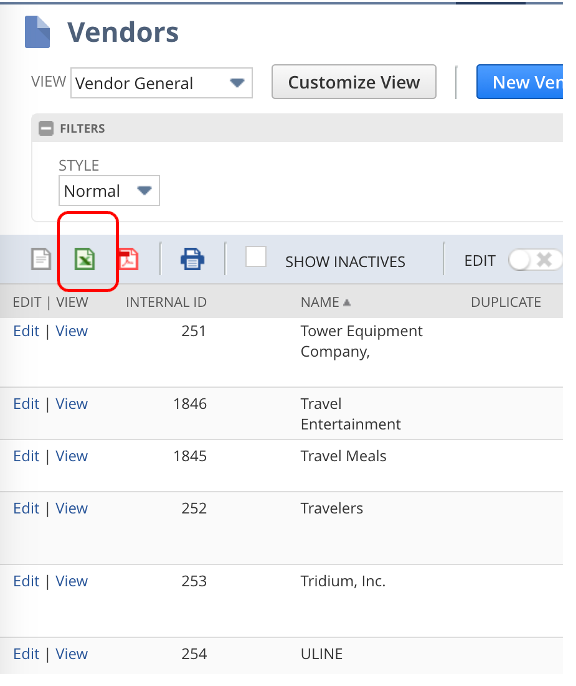

a. NetSuite Internal IDs are displayed in the list view. To find this view, navigate to List>Relationships>Vendors, and then you can export the list by clicking the green Excel icon.

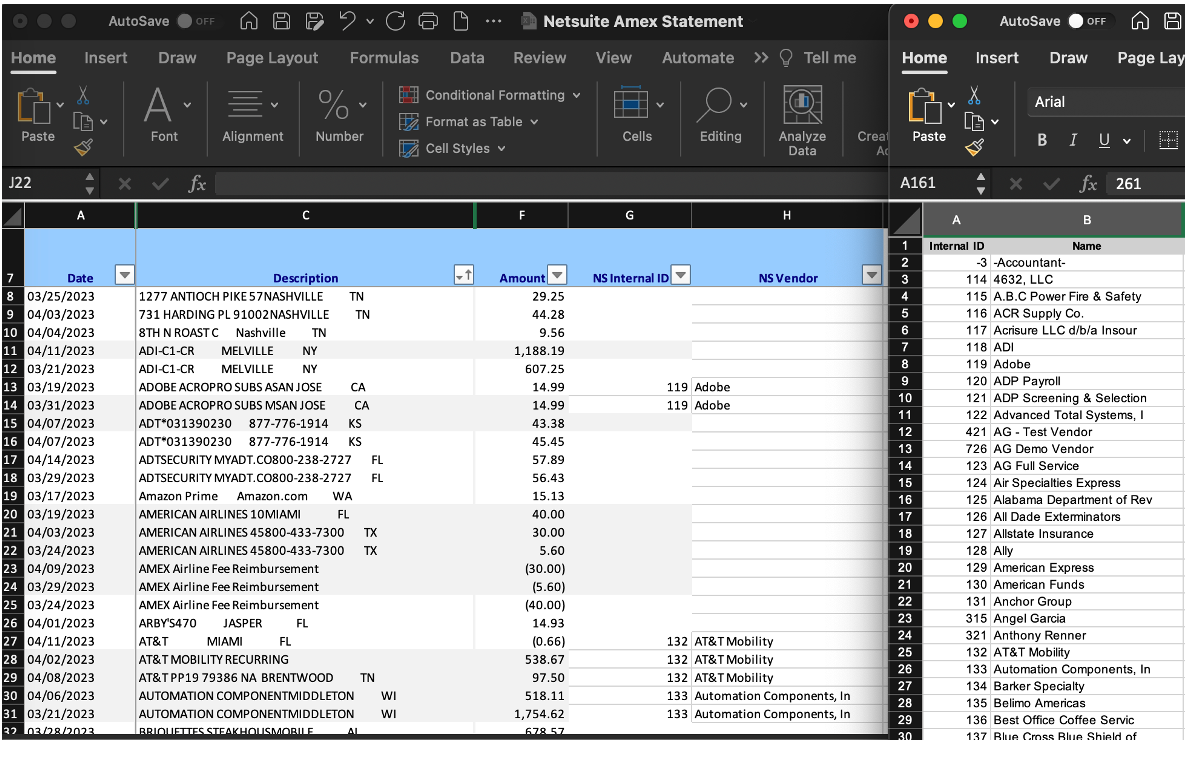

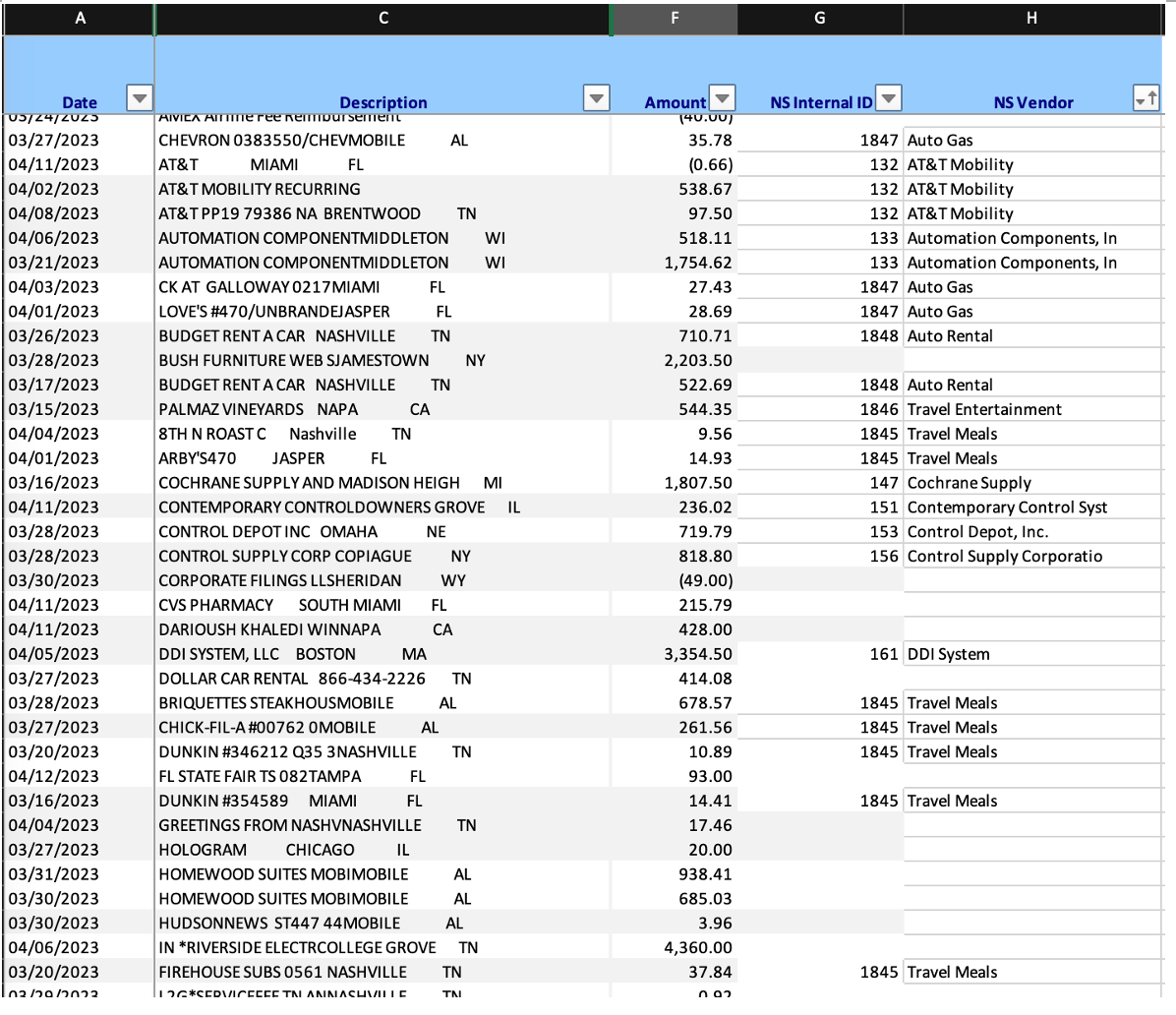

5. Export transactions from each type of card, like AMEX.

6. Add columns for NetSuite Internal ID and NetSuite Vendor.

a. Sort alphabetically by description.

7. Compare results to the NetSuite Vendor mapping document and copy the NetSuite ID and Vendor for those that match.

8. Assign those NetSuite ID/Vendors in the AMEX statement spreadsheet.

9. Add generic vendors and IDs to the AMEX list to prepare the file for upload.

a. Every line requires a NetSuite Vendor and internal ID assignment.

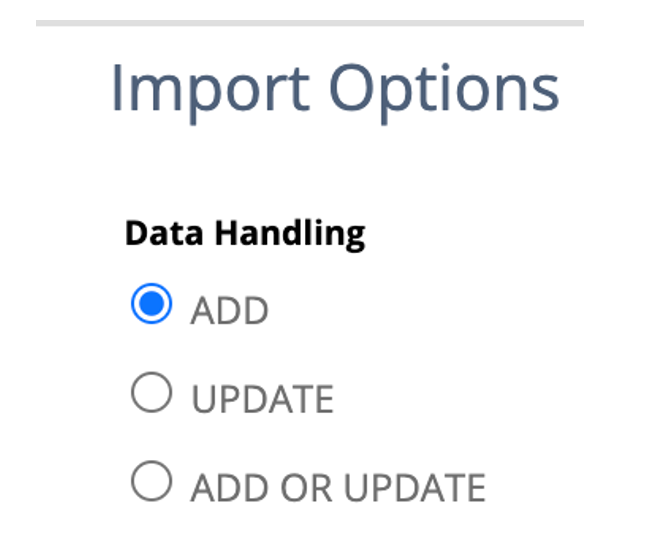

10. Create and save a CSV import to load the data. Once it's created, you may use it each month to import the data.

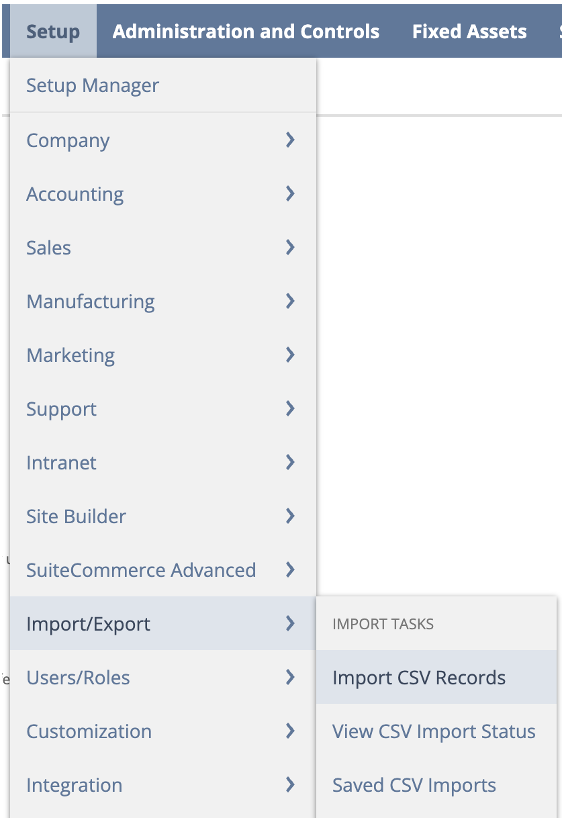

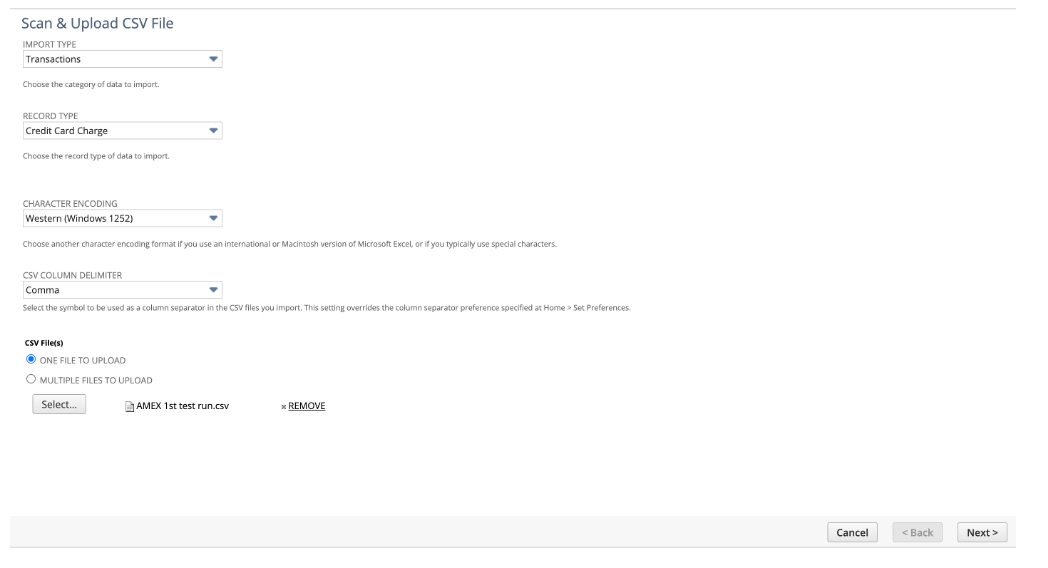

11. Select “Transactions” under Import Type.

12. Select “Credit Card Charge” under Record Type.

13. Select your file in CSV format.

14. Click Next in the lower right.

15. Add the records.

16. Click Next.

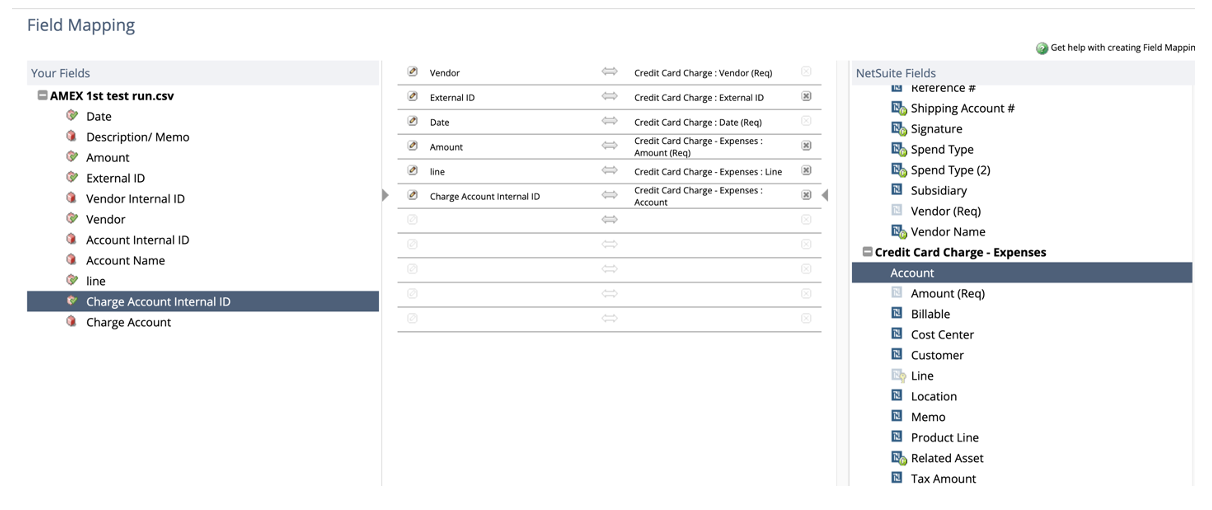

17. The spreadsheet fields appear on the left, and the available NetSuite fields appear on the right.

18. Match your spreadsheet fields to the NetSuite fields.

a. Click on the next blank line on the left. An arrowhead will appear and indicate where the system is pointing.

b. Click on a field from the spreadsheet.

c. Click on the blank right side of the same line.

d. Click on the corresponding NetSuite field.

i. There are Header and Detail fields. You can expose the Detail fields by clicking the Expansion box (i.e., Credit Card Charge - Expenses).

e. Continue until all spreadsheet fields are mapped.

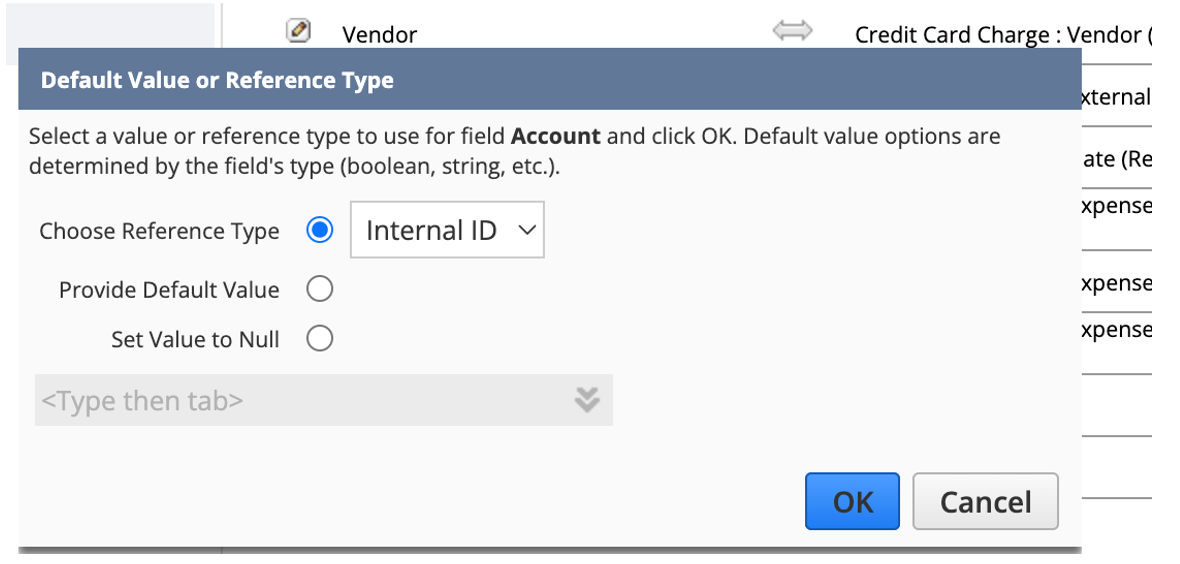

19. Ensure all fields with the internal ID are indicated as such:

a. Click the Pencil next to the field name in the above list to get the pop-up.

b. Choose Internal ID.

c. Click OK.

20. Click

Next.

21. Give the import map a descriptive name.

22. Click Save & Run.

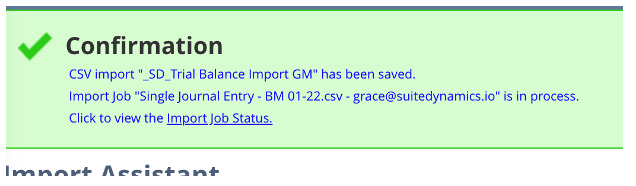

a. Click the link Import Job Status to see the job status.

23. When the job finishes, click CSV Response to see the error list.

a. If you see no errors, the transactions were successfully loaded.

b. The credit card upload details are then available for credit card Match Bank Data Reconciliation.

24. When payment is due, you may do one of two things:

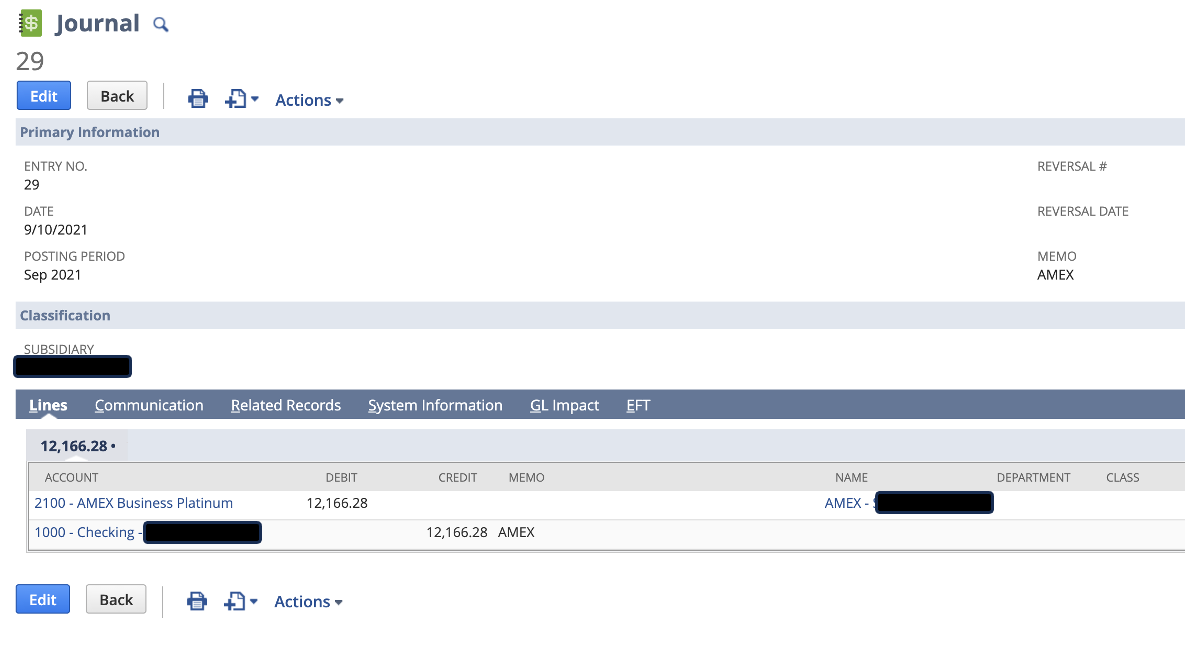

- Create a Journal Entry.

i. Enter the due date under Date.

ii. Debit the AMEX Liability Account. Under Name, enter the AMEX vendor name. (This is required to post correctly.)

iii. Credit “Cash Account.”

b. Or, enter a VendorBill and Payment via Transactions>Payables>Pay Single Vendor.

25. Match Bank Data

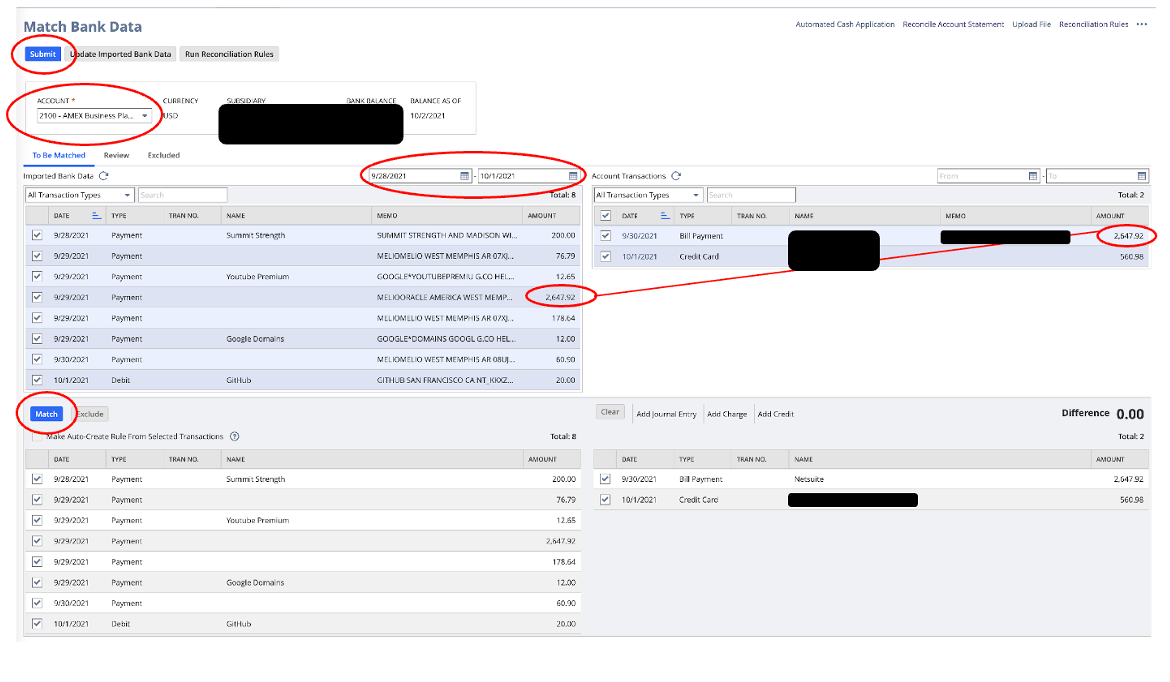

- Navigate to Transactions>Bank>Match Bank Data.

- Choose the AMEX Liability Account.

- Enter the desired date range. (From the credit card statement, begin a few days before the first day of the statement to allow for a float on the charges.)

- The imported daily transactions appear on the left, and the transactions entered directly into NetSuite appear on the right.

- Match the transactions by checking the box.

- When all transactions are matched, the “difference” at the bottom will be zero.

- Click Match in the bottom left quadrant.

- Click Submit on the top left of the screen.

26. Statement Reconciliation

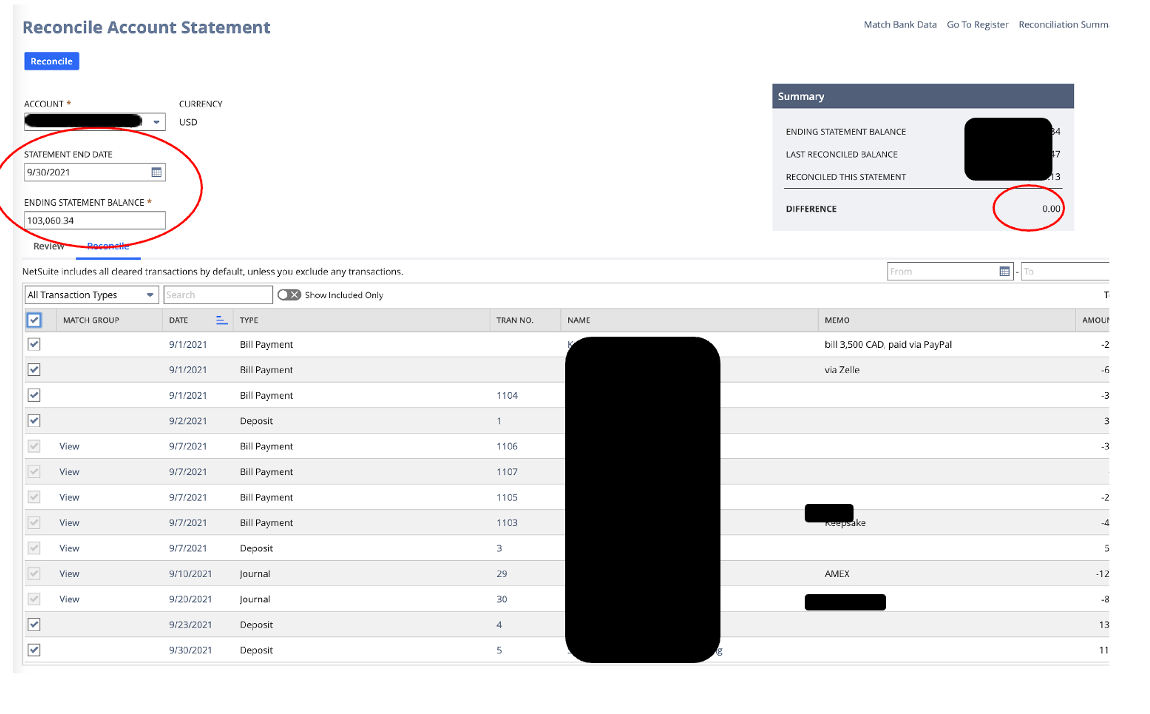

a. Navigate to Transactions>Bank>Match Bank Data.

b. Choose the AMEX Liability Account.

c. Click Reconcile Account Statement at the top right of your screen.

d. Enter the Statement End Date and Ending Statement Balance.

e. Check all transactions to clear. (Checking the box in the header line will automatically check all transactions.)

i. If you have a Difference, you must review the transactions to determine which haven’t cleared and uncheck the box on the left of the row.

f. When the Difference equals zero, click Reconcile.

Schedule a free consultation with SuiteDynamics experts if you have questions about NetSuite credit card processing or another system function or feature. We’ll devise a custom training program and equip your team with the skills necessary to succeed with the system.

Don’t struggle with NetSuite unnecessarily. Instead, have your team educated quickly and thoroughly so you can put your focus back where it belongs—on company growth.

Empower Your Staff with NetSuite

A NetSuite ERP can feel intimidating at first. It’s a massive system with a million moving parts, and it seems impossible to master. But trust us, it’s not.

We know your staff wants to conquer this system, and our SuiteDynamics experts are ready to help them do it. Our training programs cover everything from

bank reconciliations to dashboard customizations.

We know you’ve got the right team to run NetSuite successfully. Let us prove it to you.

We pull information from NetSuite material, SuiteDynamics experts, and other reliable sources to compose our blog posts and educational pieces. We ensure they are as accurate as possible at the time of writing. However, software evolves quickly, and although we work to maintain these posts, some details may fall out of date. Contact SuiteDynamics experts for the latest information on NetSuite ERP systems.