Jarrett Parr is a Financial Systems Implementer for SuiteDynamics, a NetSuite solutions provider. He enjoys analyzing and improving processes for both our company and clients. He also loves solving accounting and financial problems for growing businesses. Jarrett lives in Madison, WI, with his wife, Abbie, and their golden retriever, Clark.

A Quick Guide to Costing Method Types and NetSuite Accounting Software

NetSuite accommodates several different costing methods, so a customer can choose what works best for their business. But each one has its pros and cons.

As every business leader knows, costing methods are crucial. The method a company chooses determines the price of its goods, the taxes it will pay, the profits it will make, the forecast for its future revenue, and more.

That’s why companies must think through their costing process—particularly if using an enterprise resource planning (ERP) system like NetSuite. Various ERPs handle costing methods differently, so you have to choose a process that’s not only right for your business but also right for your software.

At SuiteDynamics, we know that’s a complicated choice—but we can help. Our company works with NetSuite to implement and customize NetSuite software. If your company uses a NetSuite ERP, we can help you decide which costing method will work best for your operations. Below, we’ve listed five of the main methods used in the system, their pros and cons, and how to select one in the system.

Read through the guide, and then schedule a free consultation with our team. We employ financial experts who can help organize and streamline your financial processes within NetSuite, so your company can become better, stronger, and more successful.

Key Takeaways

- Costing methods impact all areas of business finance. Your chosen costing method influences product pricing, profits, taxes, and overall revenue forecasts, making it a critical decision.

- Choosing a method that fits your ERP is essential. Different ERPs like NetSuite handle costing methods uniquely, so it’s crucial to align yours with what your software best supports.

- SuiteDynamics can guide you through NetSuite’s costing options. If you're using NetSuite, SuiteDynamics offers consultation to help you choose and implement the right costing method tailored to your business.

- NetSuite has five main costing methods. FIFO, LIFO, Average, Standard, and Serialized costing. Each has unique pros and cons and can be selected per inventory item.

- Costing methods have pros and cons. For example, FIFO suits perishable goods but may raise taxes during inflation; LIFO can cut taxes but isn’t globally accepted; average costing is simple but can be less accurate; standard costing helps with planning but needs perfect data; and serialized costing is super precise but works only for unique items.

- Expert guidance can simplify the process. SuiteDynamics provides free consultations with financial experts to help optimize and streamline your NetSuite costing, making inventory management more efficient and accurate.

What Is a Costing Method?

An inventory costing method is basically the way a company decides what its products “cost” over time. Since various expenses (like materials) can increase and decrease quite a bit, these methods help figure out what each product a company sells actually costs. That number is significant because it affects how much profit the business says it makes and what it pays in taxes.

Lisa Schwarz, NetSuite’s Senior Director of Global Product Marketing, explains in an article that the costing process helps make critical inventory management decisions.

“Inventory costing is a part of inventory control technique,” she writes. “Proper inventory control within a supply chain helps reduce the total inventory costs and assists in determining how much product a company should carry. All this information helps companies decide the needed margins to assign to each product or product type.”

Accountants also use generally accepted accounting principles (GAAP) to ensure companies don’t overstate these inventory costs.

Costing Method Varieties Used in NetSuite

Many industries have preferred costing methods, but that doesn’t mean you have to stick with the one used by yours. In fact, NetSuite accounting software lets you choose a costing method per item, so you don’t even have to apply the same one to all inventory. Let’s explore your options.

FIFO

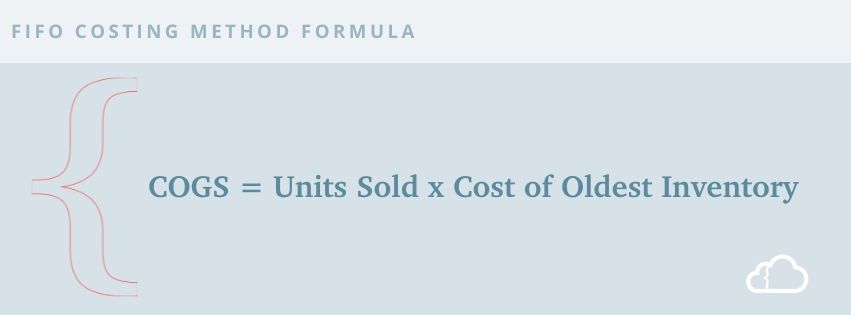

Companies traditionally use the “First In, First Out” costing method for perishable goods. A business using this method will maintain a ledger for every item purchased. (NetSuite does this automatically.) That ledger tracks and calculates the cost of goods sold (COGS) using the price of items purchased from oldest to newest.

Example: On day one, you purchase 10 widgets for $5. On day two, you buy 10 more for $6. On day three, you sell 15. The COGS for the first 10 widgets will be $5, and the COGS of the remaining five widgets will be $6.

Pros

- Saves time and money because costs are calculated using the cash flows of first-used items instead of exact costs.

- Widely used and accepted.

- Easy to understand.

- Practical approach since it helps determine the COGS at the point of sale.

- Makes manipulating income difficult when it’s reported on financial statements.

- Shows increased gross and net profits when costs rise.

Cons

- Can result in higher tax liabilities if the profits grow during inflation.

- May not work well during hyperinflation.

- Requires significant amounts of data, raising the risk of clerical errors.

- May not work for goods with fluctuating price patterns.

LIFO

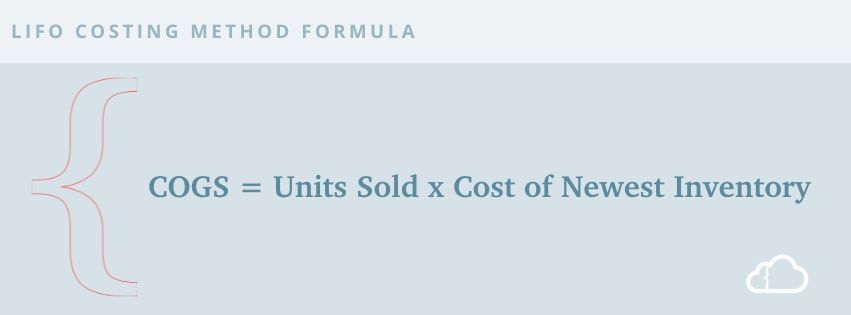

The opposite of FIFO, the “Last In, First Out” costing method calculates the COGS, starting with the cost of the most recently purchased item and working backward. Note that the International Financial Reporting Standards (IFRS) don’t endorse this method. You can only use it under the United States’ Generally Accepted Accounting Principles (GAAP).

Many companies choose LIFO because costs increase in a typical inflationary environment, leading to a higher cost of goods and lower profit per item sold. This, in turn, lowers the tax burden as net income reduces.

Example: On day one, you purchase 10 widgets for $5. On day two, you buy 10 more for $6. On day three, you sell 15 widgets. The COGS for the first 10 widgets will be $6, and the COGS of the remaining five will be $5.

Pros

- Compares recent costs to current revenues, improving the quality and reliability of earnings.

- Decreases the likelihood that a price decline will affect net income.

- Alleviates profit overstatement and, thus, lowers the amount of income tax owed.

Cons

- Drops reported earnings during inflation.

- Allows for easy earnings manipulation.

- Allows the working capital position to look worse than it is because this method understates inventory.

- Can encourage poor buying habits since companies must buy goods in large quantities to avoid reported income inflation and higher tax payments.

Average Costing

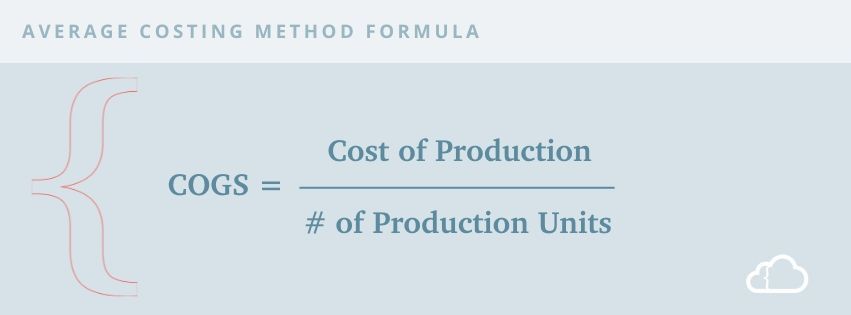

Average costing, also known as weighted average costing, calculates the COGS by totaling the cost of all inventoried items and dividing it by the total quantity. This costing method helps mitigate the effects of price fluctuation by incorporating the costs of older inventory into that of newer merchandise.

Example: On day one, you purchase 10 widgets for $5. On day two, you buy 10 more for $6. Your average widget cost is now $5.50. On day three, you sell 15 widgets for $10 each. Your COGS for each item would be $5.50.

Pros

- Simplifies calculation and record-keeping.

- Easily processes high volumes of inventory orders.

- Requires little to maintain inventory costs or calculate COGS for sales.

- Doesn’t require ongoing maintenance costs.

- Allows users to run ad-hoc or scheduled searches to find data or produce inventory cost reports.

- Widely accepted and permitted by several accounting standards.

- Useful when you can’t tell one batch of goods from another since all costs are averaged.

- Can produce data that NetSuite accounting software automatically converts into various currencies.

Cons

- May produce ending inventory cost that significantly differs from prevailing prices at a certain date, thus hampering decision-making.

- May use a rounding process for long decimals that can distort gross profit and current asset figures for large transaction volumes.

- Can cause frequent price changes if you’re using a cost-plus-pricing strategy.

- Makes it challenging to determine an item’s value since all goods lose their identity during averaging. This can cause problems when a unit’s age factors into the pricing.

- Can still be affected by cost fluctuations if you buy large quantities at the start or end of a period, particularly if the cost of those purchased goods varies significantly from the rest of the period.

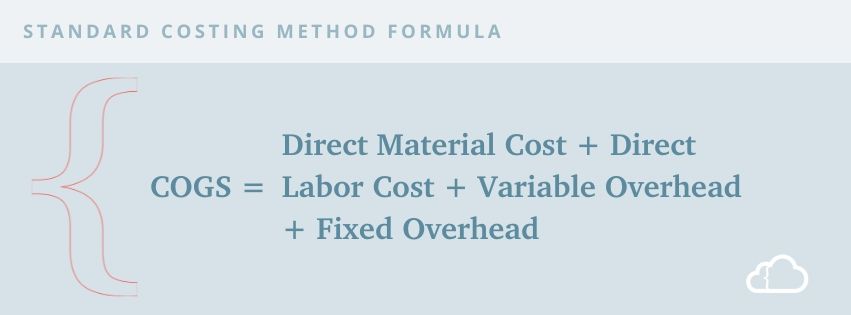

Standard Costing

Standard is the traditional costing method for manufacturers. It bases the COGS on a predetermined, estimated cost for each inventory item. Then, when actual costs differ from the estimate, the difference is captured in a variance account. Eventually, the company must reconcile that account to get an accurate idea of its current inventory value.

Example: A widget is composed of two components, part A and part B. At the beginning of the year, you estimate part A will cost $2 and part B will cost $3, so the estimated cost of a widget is $5. Therefore, the COGS for the product will be $5.

However, after three months, data shows the actual cost of part A is $4. A variance account will capture the difference in actual cost versus expected cost. Consequently, your COGS would remain $5, and you would also have a variance account for part A, debited $2. After an inventory reconciliation, you would account for the debit in the variance account and add it to the inventory cost of part A, making it $4 and the price of the widget $7.

Pros

- Can be compared with actual cost to measure efficiency.

- Can measure employee productivity and efficiency, depending on positive or negative variances.

- Fixes standards for specific activities, encouraging employee efficiency.

- Helps estimate production costs when the actual production cost isn’t known.

- Allows management to control production and decide cost elements, like wages and material purchases.

- Emphasizes cost-effectiveness and quality, improving production.

- Identifies waste in the production process.

- Helps accurately estimate the cost of new products.

Cons

- Uses standards that are difficult to determine, and incorrect standards can cause losses.

- Uses standards that must be revised periodically to reflect current marketing conditions, technology, and consumer habits.

- Requires specialists and experts to set standards.

- Expensive to use since standards must be carefully researched and analyzed.

- Only viable when you use budgetary techniques.

- Only suits companies with uniform production and set quality.

- Requires three steps for every inventory item entered with NetSuite accounting software.

- Can become frustrating since NetSuite accounting software doesn’t allow any actions until you set a predetermined standard on an item bracket. This includes transaction processing and receiving an item against a purchase order.

- Tedious for users with inventory in tens or hundreds of thousands.

- Requires that you perform a standard cost rollup with NetSuite accounting software to update the assembly cost (process shown later in the post).

- Requires that you revaluate standard cost inventory in NetSuite to calculate an updated inventory cost (process shown later in the post).

- Can take hours or days to complete in NetSuite if you have an extensive inventory. This can cause a lag in data accuracy.

- Can only be done using a single currency at a time, creating difficulties for multinational corporations.

Note: Standard costing requires nearly perfect data to work correctly. However, companies without flawless data can use a custom field in NetSuite that mimics standard cost functionality.

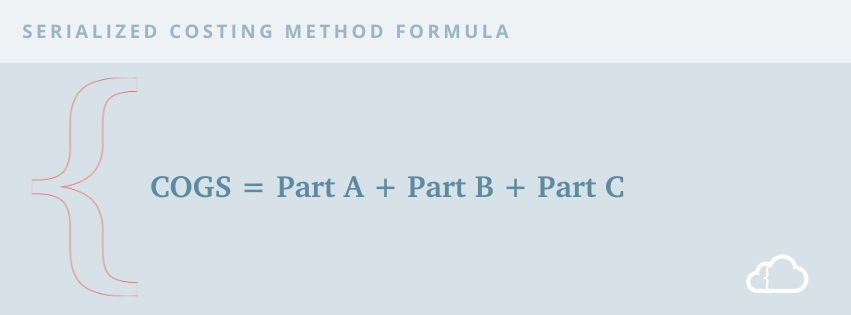

Serialized Costing

With this costing method, an ERP accounting system can track each part or item individually using unique serial numbers. If the parts are used in a project, the COGS for the project will reflect the exact sum of every individual part used.

Example: Widget 001 was built with parts A ($3), B ($4), and C ($5) for a total COGS of $12.

Pros

- Highly accurate since you can record exact costs in inventory records.

- Offers greater accuracy with gross profitability since an item’s actual cost is used for the COGS when the serialized item is sold.

Cons

- Tedious for any business with a large inventory.

- Can only be used with lot/serialized item types.

- Can’t be used to track all items in a company’s system because not all have unique lot/serial numbers.

- Restricted to specialized items and businesses involved in equipment, cars, etc.

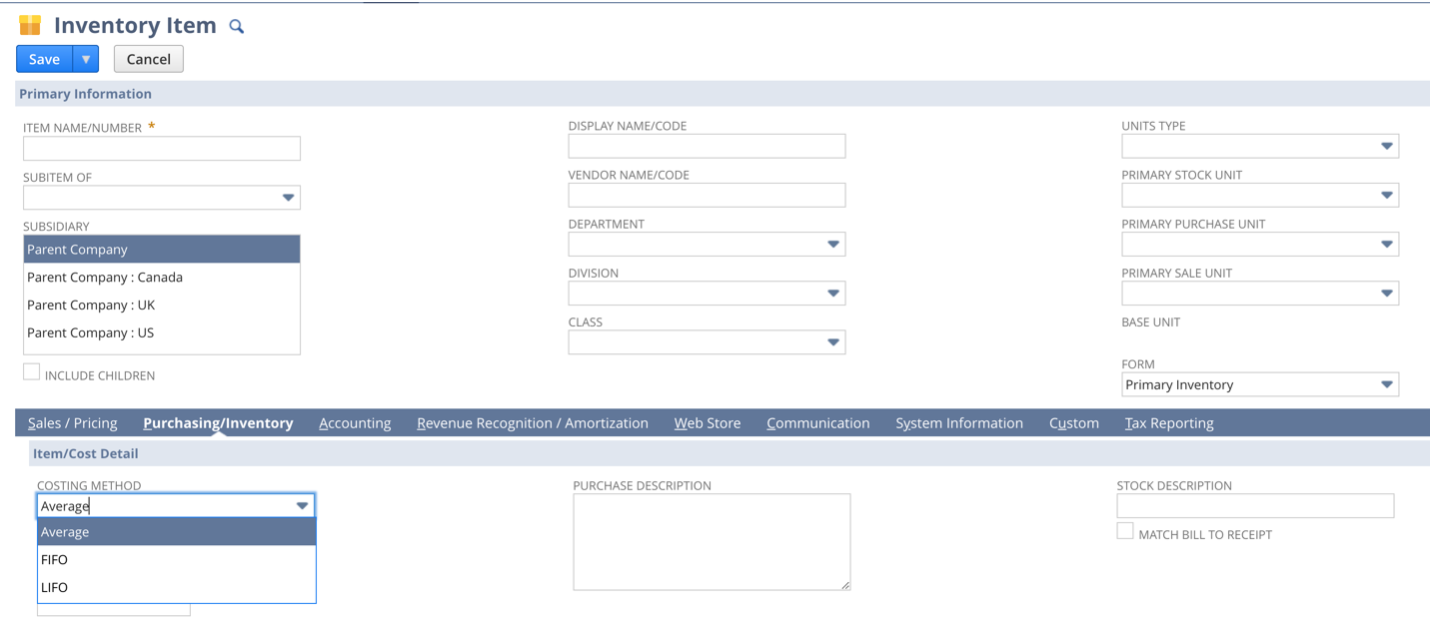

Selecting Costing Methods with NetSuite Accounting Software

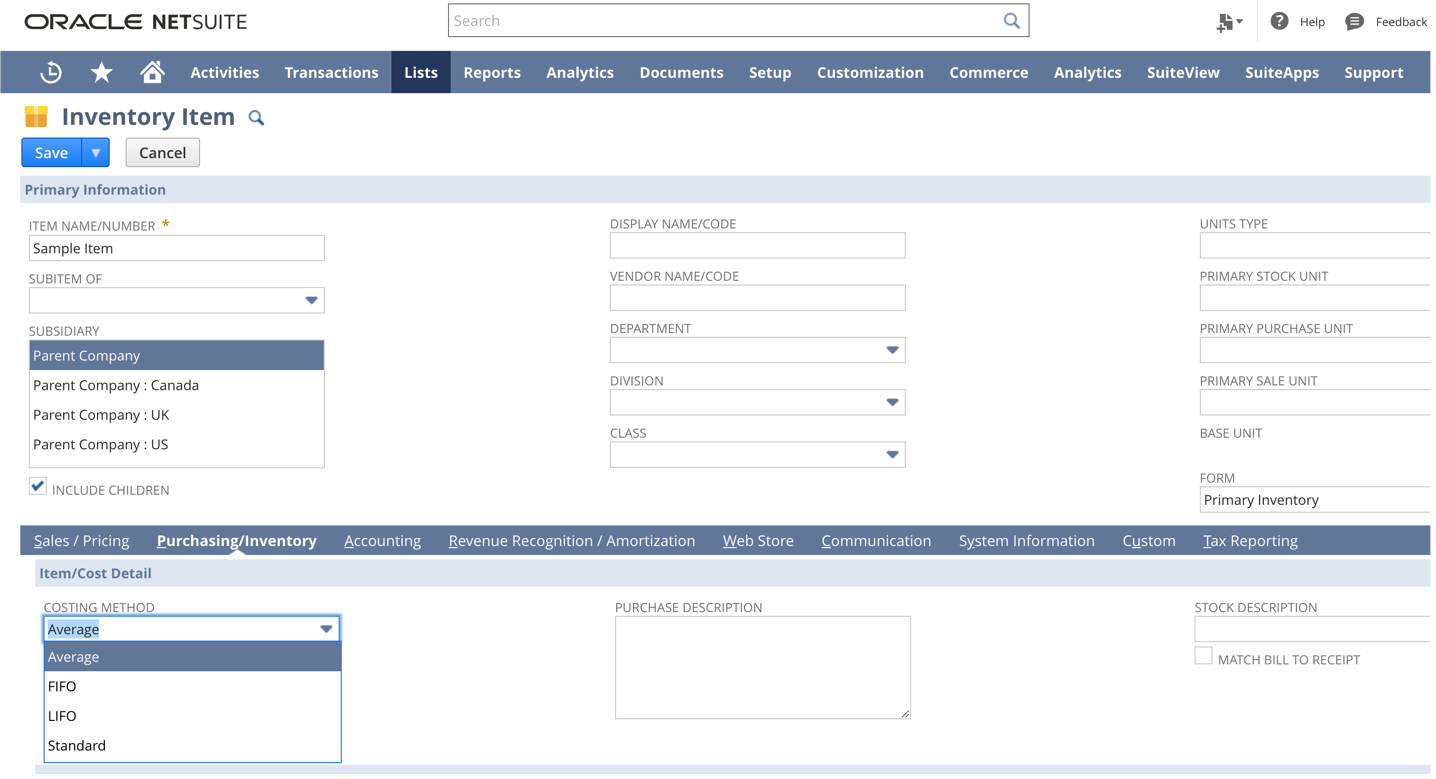

Select a costing method when creating an item. You can find the Costing Method dropdown menu under the Purchasing/Inventory subtab.

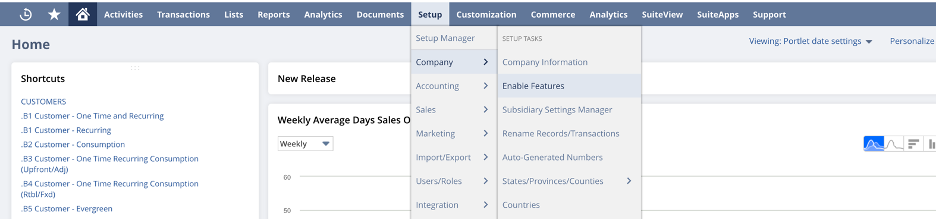

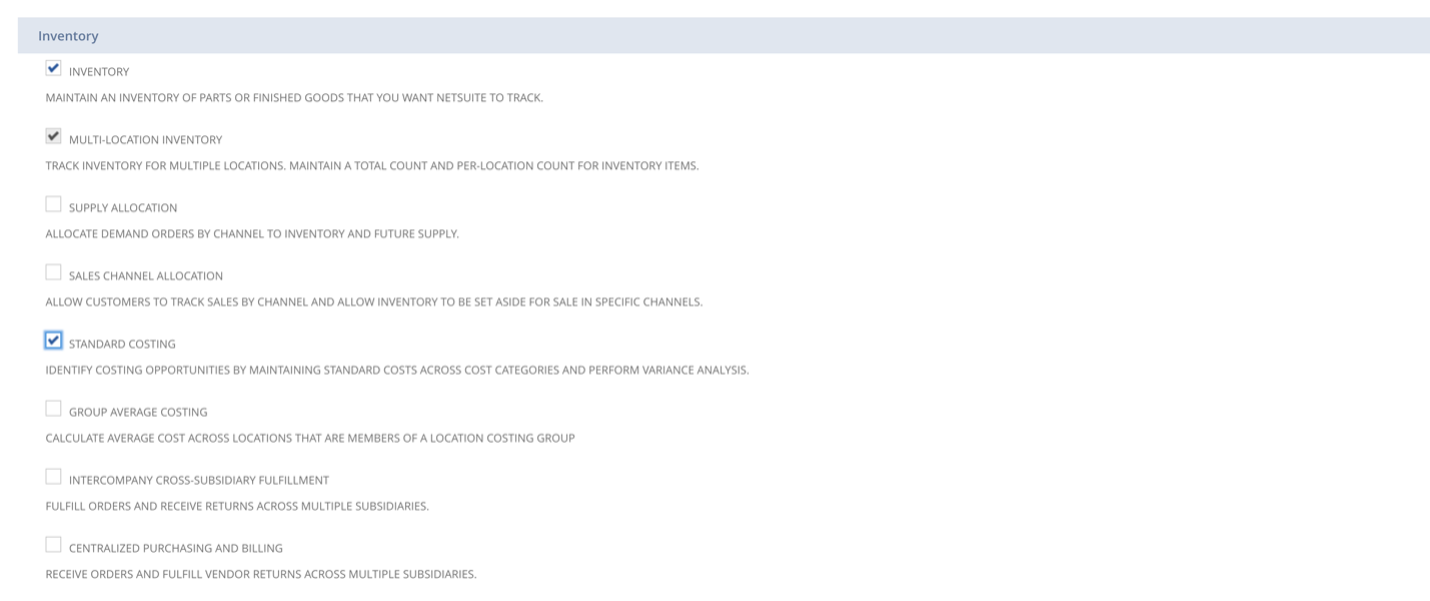

By default, standard costing won’t be enabled in NetSuite. To enable it, navigate to Setup > Company > Enable Features.

Then, click on the Items & Inventory subtab.

Scroll down to the Inventory section and check Standard Costing. Then, click Save.

Now, standard costing will be available from the Costing Method dropdown.

Performing a Standard Cost Rollup in NetSuite

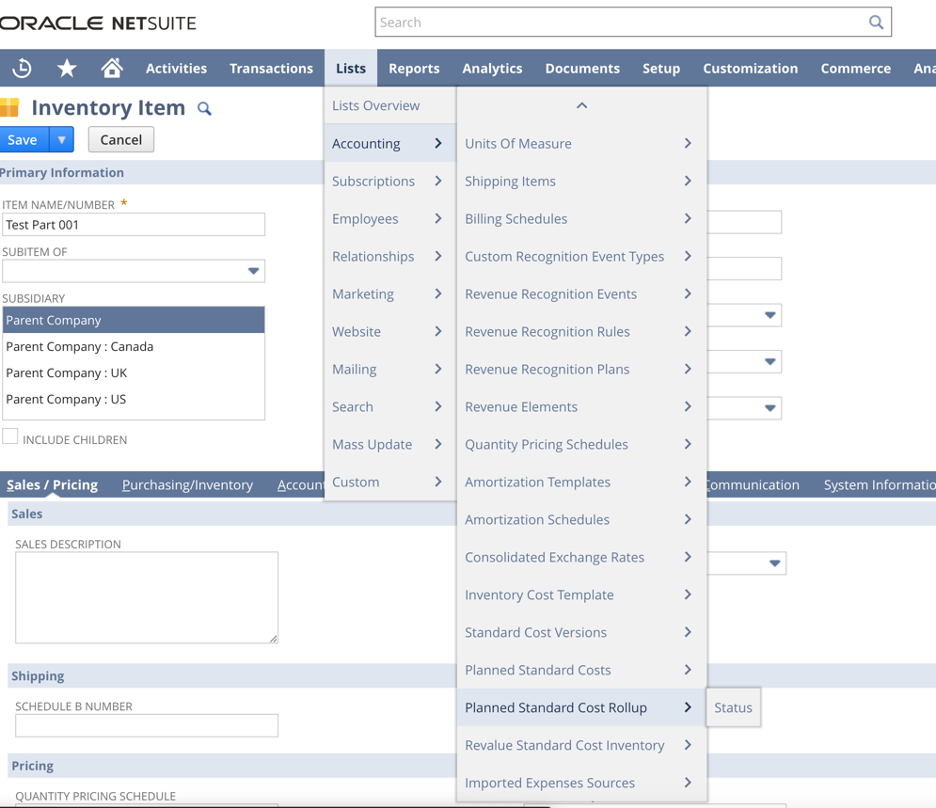

Navigate to Lists > Accounting > Planned Standard Cost Rollup.

Performing a Revaluation of Standard Cost Inventory in NetSuite

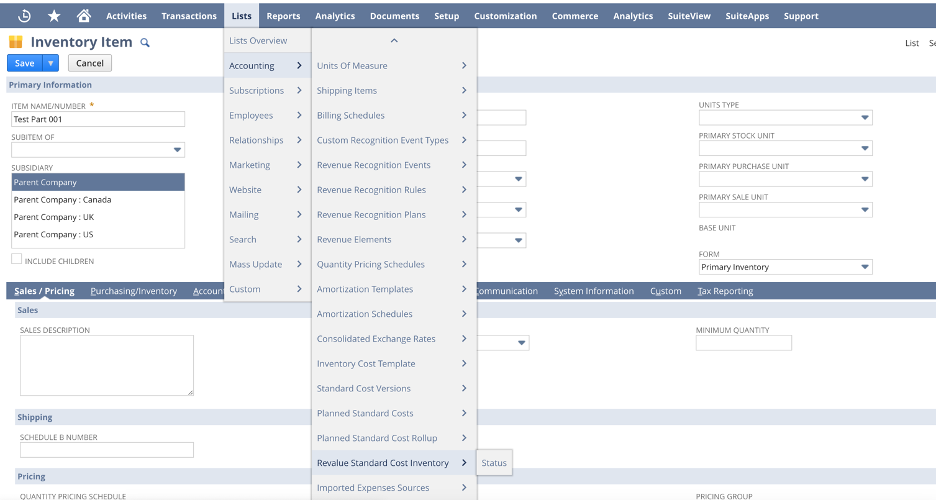

Navigate to Lists > Accounting > Revalue Standard Cost Inventory.

The right costing method may determine whether your business experiences profits or losses, so choose carefully. The SuiteDynamics experts can help determine which will best serve your company in the market and in NetSuite. Schedule a free consultation with our team, and let us know how we can help.

Frequently Asked Questions

1. Which costing method is best for tax reduction purposes?

LIFO typically results in lower taxable income during inflationary periods because it assigns higher, more recent costs to goods sold. However, it's only permitted under US GAAP, not International Financial Reporting Standards (IFRS). Average costing can provide a middle ground with moderate tax implications, as it smooths out price fluctuations by averaging all inventory costs. Standard costing, while not typically chosen primarily for tax purposes, can help manufacturers identify and address cost variances that might ultimately reduce taxable income through improved efficiency.

2. Can a company change its costing method after implementation?

Yes, but it would involve an enormous amount of work. A costing method cannot be changed on an item once set, requiring you to recreate entirely new items from scratch. The switch to begin using these new items would be similar to a go-live, likely requiring a go-dark period for business operations while you load new items and deactivate old ones. This can also impact any reports or metrics that utilize items and can require additional steps for accurate historical reporting. It would be a significant undertaking, so it’s better to get your costing method right before going live.

3. How do costing methods impact financial reporting and business decision-making?

Costing methods directly affect key financial metrics, including gross profit, net income, inventory valuation, and tax obligations. FIFO typically shows higher profits (and potentially higher taxes) during inflationary periods, while LIFO shows lower profits. Average costing tends to stabilize these metrics by blending costs over time, which can provide more consistent reporting periods. Standard costing offers manufacturers unique insights through variance analysis, revealing efficiency problems and opportunities for process improvement. These differences influence critical business decisions about pricing strategies, purchasing patterns, and expansion plans. Companies should select a method that complies with relevant accounting standards and provides the most useful information for their specific industry, inventory characteristics, and management objectives.

Blow Away the Competition

Stop fighting a software system that's working against you. Instead, enjoy the benefits of an ERP that knits your operations together seamlessly and provides the data and analysis you need to trounce your competition.

We know you can rise in your industry.

Team up with SuiteDynamics to develop the ERP system your business needs. As NetSuite solution providers, we license, customize, and implement NetSuite ERP software for clients in any industry.

The partnership doesn't stop there. We can continue working together long after go-live, maintaining the system, training staff, and adjusting the software to accommodate your expansion. Start by scheduling a free consultation with our team.

We pull information from NetSuite material, SuiteDynamics experts, and other reliable sources to compose our blog posts and educational pieces. We ensure they are as accurate as possible at the time of writing. However, software evolves quickly, and although we work to maintain these posts, some details may fall out of date. Contact SuiteDynamics experts for the latest information on NetSuite ERP systems.