10 Automated Financial Processes to Consider

How automation can help reduce costs and scale your business.

Chapter 1

The Automated Financial Processes You Need

Essentially, your company will benefit from automated financial processes because they save time and reduce reporting errors. And the more you automate, the smoother your business will run and the less stress you will feel.

Many companies automate their accounting and financial processes first since that data is critical to everything a business does. So, let’s examine 10 financial systems you might consider automating. Then we’ll discuss how an ERP can integrate that automation seamlessly into your operations.

Data Entry

Businesses start by automating data entry. A recent Robert Half survey shows that a growing number of companies have automated data entry and collection in the last few years.

Companies usually introduce some automation as they implement their accounting systems. And different technology levels can automate data entry. These levels include importing data and enabling rules-based workflows, robotic process automation (RPA), and more advanced artificial intelligence (AI) technologies.

Automated financial systems, on one level, may involve importing and reconciling bank statements or integrating with other systems (such as a point-of-sale system) to pull accounting data. Fully automated data entry tools can source information from structured and unstructured documents without human intervention. They do this using software such as optical character recognition (CR) technology to, say, automatically capture data from paper documents, emails, or PDFs.

You can also program software with machine learning. Then, this software can, for instance, “read” a bank statement and correctly move around data in the accounts receivable solution.

The benefits of fully automating all data entry and capture processes are obvious. You receive more accurate data, spend less time verifying and reconciling data, and get more time to analyze information that drives more efficient systems.

Accounts Payable (AP)

An automated accounts payable process ensures your business pays its bills on time. It also takes advantage of optimal payment terms so you can hold on to cash longer and receive offered discounts. AP automation technology also matches invoices to supporting documents, such as purchase orders and receiving forms, so you don’t have to pair them manually.

Manual expense management wastes money and employee patience as your staff arranges receipts, mileage logs, and more.

This capability saves time and reduces mistakes. Additionally, digital workflows can alert necessary approvers when they need to green-light invoices so those bills get paid on time.

Accounts Receivable (AR)

According to Robert Half, invoicing is one of the most commonly automated processes. Automated financial systems can typically generate invoices, route them to stakeholders for approvals, and email them to customers. And more progressive accounting software can automatically set customer credit limits and recognize early the signs of customer financial trouble before responding accordingly.

Automating the entire invoicing process can also decrease days sales outstanding. Even firms that don’t send that many invoices benefit here because days sales get reduced by 15 days compared to those using manual AR processes. Therefore, this automation produces a more predictable cash flow and prevents resource waste caused by tracking down delinquent customers.

Expense Processing and Management

Manual expense management requires keeping, organizing, and managing a lot of paper and spreadsheets for accounts payable and receivable. It wastes money and employee patience as your staff arranges receipts, mileage logs, and more. Then, workers and accounting teams inevitably engage in a lot of back and forth as they decipher info and clarify policy.

That’s why companies are now automating expense management and simplifying the process of submitting, processing, and reimbursing expenses.

Of course, automation has other benefits, too, such as eliminating paper, collecting the data necessary to curb spending, preventing expense fraud, and increasing policy compliance. Expense management automation can even help prepare and pay federal income taxes by tracking and calculating deductible expenses.

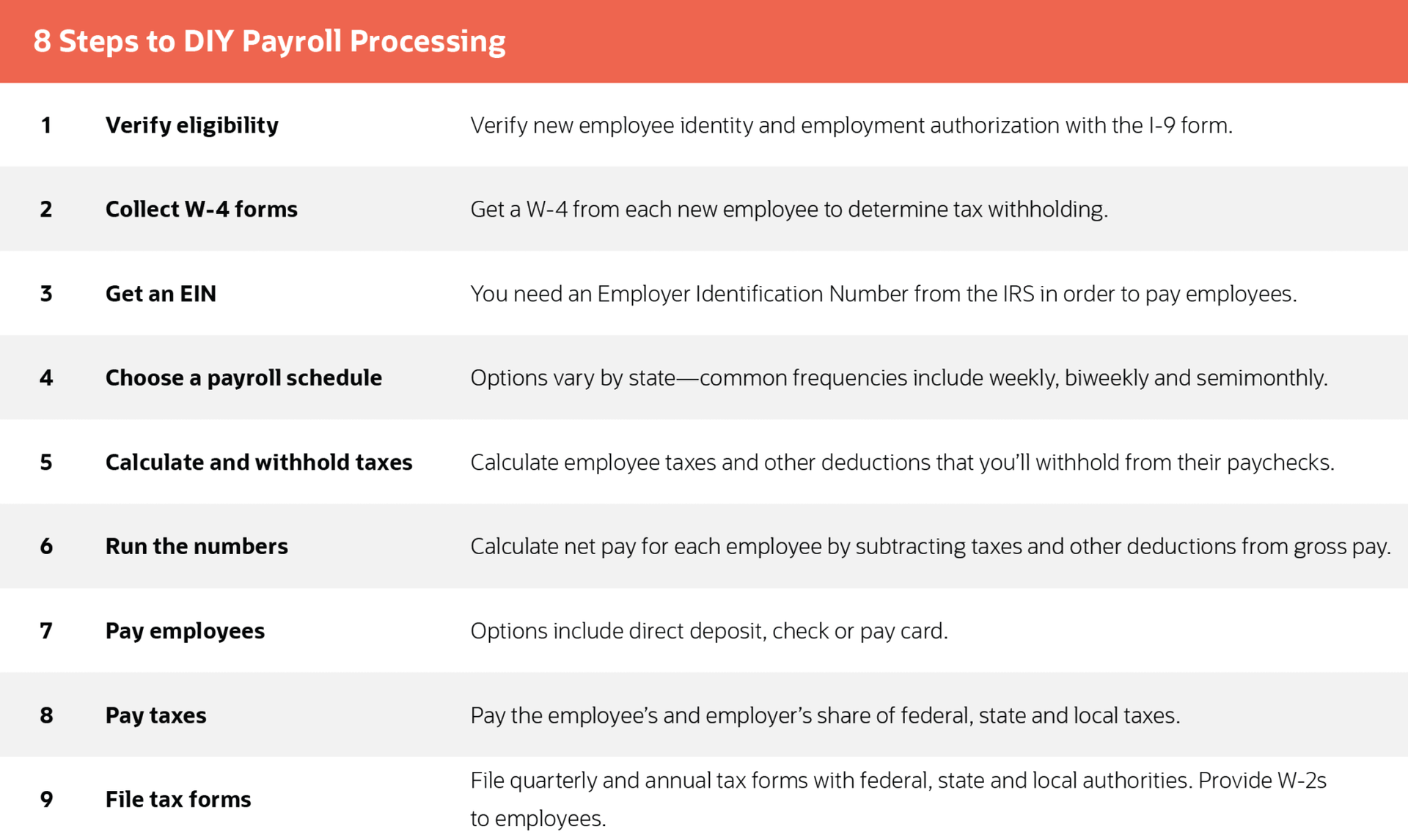

Some may also consider payroll management one of the most tedious and time-consuming aspects of running a small business. This seems particularly true since a business must stay updated on changing wage and tax laws. However, payroll software eliminates manual inputs, increasing efficiency and reducing errors and other headaches. So, payroll managers and employees will have more time to focus on valuable tasks.

Payroll software can also:

- Accurately calculate paychecks. It accounts for factors including wages, tax withholdings, location, and benefits contributions. This eliminates manual calculations.

- Calculate overtime, holiday, and after-hour pay as necessary. Payroll software makes tracking complex schedules much easier, whether you’re following company policy or complying with federal or state regulations.

- Track time off requests for vacation or sick days.

- Stay up to date with tax and wage laws on federal, state, and local levels. This saves time and ensures compliance.

- Automatically pay employees via direct deposit or pay cards.

- Determine commission payments.

Purchase Orders

The purchase order process connects the procurement and accounts payable departments with stakeholders from various departments. Consequently, it can create a string of back-and-forth messages that are difficult to track and slow operations. Missed key dates or delayed purchase order approvals can also cause supply setbacks, impacting production and profits. As a result, your organization might not get a product or service from your first-choice vendor because you couldn’t act quickly enough.

Fortunately, automated financial systems can ensure visibility, accuracy, and efficiency. For example, automated workflows alert approvers when a purchase order is ready for review so they can move it along quickly. And when you integrate procurement processes with accounts payable systems, vendors will receive timely payment because the software automatically matches invoices with purchase orders and receipts. So, employees can spend less time processing purchase orders and more time looking for outliers, patterns, and potential problems—like fraud.

Financial Reporting

Many companies also automate financial reporting, including financial statement production. This helps explain why Robert Half says financial reporting took businesses 10 days on average to complete in 2019, compared to 13 days in 2018. In fact, an impressive 39% of organizations under the $500 million revenue mark have automated financial report creation.

Automation ensures that financial reports are correct and their data is transparent and credible. This accuracy is necessary for any business event—such as reporting to the bank, satisfying investor needs, and reporting earnings. Plus, automation offers financial professionals more time to analyze results. And it gives internal and external stakeholders critical information quickly so they can make good decisions.

Consolidated Financial Processes

Some organizations take days to build reports for management. They must create a spreadsheet, collate everything, and ensure information lines up correctly. The process gets even more complicated when it involves different currencies, exchange rates, local tax codes, and accounting regulations. So, automated financial systems offer companies a huge advantage because they establish a unified view of finances across the business.

Leading automation systems also allow users to tag inter-company purchase and sales orders and link them so accounting doesn’t have to match pairs. The software also identifies revenue and expenses associated with inter-company transactions and removes them from consolidated financials during the close process.

Budgeting and Forecasting

Budgeting and forecasting can become increasingly complex as an organization grows. However, you can ease the process by integrating your financial planning and budgeting system with your accounting system. This combination pulls all the financial and operational information required for forecasting and budgeting from your core financial solution.

A planning and budgeting application enhances predictive capabilities.

You also don’t need to import and export data or enter it manually. And all stakeholders work with the same source of accurate data, which updates in real-time. Users can also adjust a few numbers to study their impact without creating multiple budget versions. So, although you can’t fully automate the budgeting and forecasting process, you can eliminate parts of it and reduce the time and energy accounting teams spend on it.

With such a system, stakeholders can easily track and stick to budgets. Numbers are also easily accessible for forecasting. And prebuilt reports and dashboards make it easy to compare numbers, spot trends, and make data-driven decisions.

Furthermore, a planning and budgeting application enhances predictive capabilities. It supercharges spreadsheets and allows users to pull and push data directly from the underlying database. They can then analyze the information and create visualizations that communicate data using embedded and interactive financials.

Sales Tax

Sales tax is complex. Not every state requires vendors to levy and remit sales tax. But the 2018 Supreme Court ruling in South Dakota v. Wayfair allowed states to require businesses without a physical presence in the state (and above certain sales thresholds) to collect and remit sales taxes. Many states have also enacted legislation to tax e-commerce sales on the principle of sales tax nexus.

In addition to state requirements, your company must also worry about hyper-local laws. For example, customers with the same five-digit ZIP code don’t necessarily have the same sales tax rate. And a single ZIP code can include multiple tax jurisdictions or contain special zones where additional tax surcharges are levied. So, vendors must apply sales tax more precisely by asking customers for their full, nine-digit zip code.

To build strong relationships, you must also track sales tax-exempt customers (like government agencies and nonprofits). Typically, people don’t appreciate misapplied sales tax charges. So, as a business, you carry the burden of calculating proper sales tax. You usually accomplish this by collecting and tracking tax exemption certificates. And when completed manually, this becomes a time-consuming and error-prone process.

Therefore, you can eliminate manual tax calculations using an accounting system with built-in tax logic. Such an engine determines whether and how much you should tax for every sales transaction. A robust platform updates automatically, reflects tax laws changes, and accommodates sales tax holidays or tax-exempt products. It also ensures sales tax accuracy by using the zip + 4 to pinpoint tax by a specific address. Plus, it manages exemption certificates with validity dates for customers and vendors.

Chapter 2

How ERP Addresses These Challenges

ERP software automates business processes by collecting your organization’s information in a central database and using it to automate workflows. ERP systems not only provide the platform for process automation, but they also help establish and maintain rules that ensure compliance with legal and regulatory mandates.

For example, the accounting modules connected to ERP systems establish strong financial controls. They also ensure your business adheres to all applicable regulatory and accounting standards.

Most businesses start by creating automated financial systems associated with core financials and gradually move to other aspects of their organization. For instance, you might establish an accounting solution that automates accounts receivable and payable. It would extract information from invoices, organize them by due date, and automatically send bill reminders to customers. That automation should simplify closing the books, so your accounting team could feasibly have financial statements prepared within a week of the quarter’s end.

You might also add an expense management system to your ERP that allows employees to upload receipts and submit reports online. Then, you can set custom approval rules that route each document to the right manager. We suggest getting all these applications from the same vendor to avoid costly and unreliable integrations. The best approach for most organizations involves a unified ERP platform with modules that support various business functions.

ERP systems also tie business processes together, allowing the technology to mirror, guide, and improve your business operations.

For example, an order-to-cash process for a products company touches the inventory management, order management, accounts receivable, and possibly credit management systems. An ERP platform hands the process off from one department to another to complete the transaction. Meanwhile, it also tracks that data for financial reporting, forecasting, budgeting, analysis, and more.

Yet, ERP systems also extend far beyond accounting and can scale to address the growing needs of a business.

More businesses are implementing ERP to establish end-to-end automation, and most are looking to the cloud. As a result, spending on cloud-based enterprise software is growing at a healthy clip, and that trend is sure to continue.

The most robust cloud-based platforms, like NetSuite, include many technologies needed establish automated financial systems. And most importantly, they provide a single source of real-time, accurate information to ensure automation creates the intended benefits.

Contact the SuiteDynamics experts if you want to know more about how a cloud-based ERP system can automate your business processes.

Also, follow us on Twitter, Facebook, LinkedIn, and Instagram for educational content and industry updates.